AUDCHF: Australian Dollar-Swiss Franc Rate, Chart, Forecast

Foreign exchange (forex) is generally traded in pairs, wherein one currency is bought, and one is sold simultaneously. It is one the most complicated financial markets, with trillions of dollars’ worth of trades placed and executed on a daily basis. While the majority of the forex trades are dominated by governments and banks, retail investors can also partake in these markets by trading currency pair derivative contracts. The high liquidity and short investment time frames make forex one of the most popular over-the-counter investment markets among retail investors. One of the most popular currency contracts is the Australian dollar and Swiss Franc, or AUDCHF.

What is AUDCHF? Overview

AUD/CHF is the exchange rate quoting the price of the Australian Dollar per unit of Swiss Franc. Australian dollar (AUD) is the legal currency tender of Australia and several independent islands in the South Pacific region, namely, New Guinea, Papua, Christmas Island, Nauru, Tuvalu, Cocos, and Norfolk islands. It is the fifth most traded currency in the world. However, AUD has witnessed substantial fluctuations over the past two years, primarily due to the Covid-19 pandemic fueled uncertainties and tumultuous relations with China.

On the other hand, CHF (Confoederatio Helvetica Franc) represents Swiss Franc currency, the legal tender of Switzerland and Liechtenstein. CHF is often termed as a safe haven currency due to the regional stability and strong government and is the seventh most traded currency globally. In fact, the Swiss Franc has been one of the best-performing currencies in the world amid the pandemic disruptions.

As an example, if the AUD/CHF rate is 0.67264, then this means that 1 Swiss Franc would cost 0.67264 AUD. However, banks typically charge a 1%-3% conversion fee for such currency exchanges, indicating that the actual cost of trading the Australian dollar to CHF might be higher. Moreover, forex markets remain open 24×5, unlike fixed stock market trading hours, causing AUD CHF to fluctuate constantly.

AUDCHF Chart

The following chart should allow investors to understand how the AUDCHF currency pair has performed over the past year.

How to Read the AUDCHF Chart

Analyzing the chart is the first step towards an accurate AUD CHF forecast. Technical analysts primarily study these charts to determine price targets for such currency derivatives. Over the past year, AUD has appreciated 0.65% against CHF, indicating an improved investor outlook regarding the Australian dollar. This was primarily driven by the strengthening global economic activity as the global economy emerged from the pandemic driven recession, giving investors the confidence to shift from safe haven currencies.

The currency pair is currently trading above its 20-day moving average, reflecting a bullish AUDCHF signal. Thus, technical analysts might expect the AUDCHF exchange rate to rise in the near term.

AUDCHF Historical Data

AUDCHF is generally less than 1, as the Swiss Franc is considered as a safe haven currency with relatively stable demand. During periods of economic boom, AUD tends to outperform CHF. This is because Australia witnesses higher export demand when the global economy is expanding, thereby pushing up the demand for the currency. However, during periods of volatility, CHF has historically outperformed AUD.

AUDCHF Exchange Rate History

Over the past five years, AUDCHF sentiment has declined, as the currency pair slumped 10.83%. If you look at the price performance since 2004, AUDCHF fell 28.41%. As the forex markets tend to be highly responsive and volatile, investors have been relying on the safe-haven CHF currency. Particularly during times of recession, the price of the Swiss Franc has risen relative to the Australian Dollar. During the 2008 economic slowdown, AUD/CHF fell to 0.755 from a high of 1.077 in 2007, when the markets were at their peak.

In March 2020, the currency pair fell to a historic low of 0.5871 on March 15, as most countries began announcing lockdowns to curb the spread of the virus. However, the price of 1 AUD to CHF has improved since then.

AUDCHF Exchange Rate Today

AUDCHF correlating pair is trading at 0.67264. this means that one 1 CHF is worth 0.67264. The exchange rate has improved since the first the initial days of the pandemic in March 2020, as investors are buying AUD amid strengthening economic activity. The currency pair has a relatively low bid-ask spread of approximately 0.0005, insinuating that it is heavily traded in the forex markets.

What Influences AUDCHF Exchange Rate?

1. Covid-19 Pandemic

As winter approaches, most European countries are reposing travel restrictions and partial lockdown measures. Though Australia has been relaxing its border restrictions to a certain extent lately, allowing fully vaccinated people to enter the country without needing to quarantine. However, with most countries witnessing a deadly Covid variant surge lately, Australia might face rising cases soon. Also, with the majority of the western countries on lockdown, Australian exports might decline slightly in the upcoming months, eroding the gains of AUD/CHF so far.

Alternatively, CHF might appreciate against AUD amid this backdrop, as investors are likely to rely on the safe haven currency to ride out the current market volatility.

2. Inflation and Monetary Policy

Both Switzerland and Australia are likely to maintain their dovish stance to accelerate their economic growth further. As a result, AUDCHF sentiment is favorable in the current markets. However, the rising global inflation due to the availability of “cheap money” is a cause for concern. While the Swiss National bank has vowed to keep its interest rates at the current levels despite the increased inflation forecast and surging price levels, the Reserve Bank of Australia recently announced a yield curve control policy to keep the accelerating inflation rate in check.

Rising inflation has a negative impact on currencies. As a result, both the Australian dollar and Swiss Franc are expected to depreciate if the inflation rates are unchecked, threatening the economic stability of these countries.

Many institutional investors and money managers are predicting a significant market correction early next year if the inflation rates continue to grow at the current pace, which is expected to adversely impact the forex markets as well.

3. Decelerating Economic Growth

The economic growth rate has been slowing down lately, as the production capacity hovers near full capacity and unemployment rates fall to new lows. As a result, analysts expect the currency pair to move at a relatively stable rate. While AUD still has room to improve given the rising export demand amid the holiday season, the currency will most likely appreciate at a slower pace (barring any unprecedented events).

4. Commodity Prices

The AUD/CHF pair is heavily affected by the price of gold and other raw materials, as Australia is a major exporter of raw materials. More than 20% of its GDP is from exports of raw materials, primarily iron ore, coal, and gold, to its neighbor China. In other words, China’s growth largely influences the Australian economy. Thus, AUD, unsurprisingly, has been doing pretty well since last year, as China was the first country to report positive GDP growth since the pandemic triggered a recession in the first quarter of 2020. Also, as the demand for raw materials remains strong, the AUDCHF pair should keep appreciating.

5. Geopolitical Instability

Though Switzerland generally enjoys regional stability, the current migrant crisis in the Polish-Belarus border has been disrupting the peace in the European Union for quite some time. In the South East region, Australia’s relationship with its biggest trading partner has not been great either. During mid-2020, China imposed several barriers on Australian imports. While the latter emerged from this trade war relatively unscathed, the country can’t refute that it immensely benefited from its trade relations with the world’s second largest economy. AUDCHF will gain tremendously if the geopolitical scenarios improve in both regions.

AUDCHF Forecast and Predictions

Analysts are betting on the Aussie to weaken by the end of the year. Also, commercial banks in Australia expect the currency to depreciate in the second half of 2021. Conversely, the Swiss Franc is being backed by bullish investor sentiment. This is evident from the currency recently outperforming the reserve currency, Euro.

AUDCHF has a resistance level at 0.68, ensuing that it might not cross this mark in the short term. Knowing the short term headwinds should help traders figure out the best time to trade AUDCHF.

Why Trade AUDCHF Today?

-

Improving macroeconomic conditions

The V-shaped global economic recovery has allowed AUDCHF to rise over the past year. The encroaching holiday seasonal demand is expected to offset the decelerating global economic growth until at least the end of this year, paving the way for the currency pair to appreciate.

-

Minute bid ask spread

AUD/CHF is one of the most heavily traded currencies in the world. As a result, with an enormous number of buyers and sellers in the market, the bid-ask spread is quite low, indicating sufficient liquidity. Thus, investors can generally exit their position within minutes, as the forex markets remain open 24×5.

-

Margin trading

Since currency pairs are traded in the form of derivative contracts, investors can borrow funds from their brokers to trade the currency pair. This increases the potential gains from trade, as the investor is generating profits on loaned money.

-

Safe haven investment

As CHF is a safe haven currency, the risk associated with it is limited. Investing in AUDCHF currency pairs exposes investors to the Swiss Franc, thereby limiting losses to a certain extent.

Where Can I Invest in the AUDCHF Pair?

Investing in AUDCHF on mt4 is one of the safest ways to trade the derivative, as it ensures secure transactions compliant with international laws. Zeal Capital Market (ZFX) is one of the best forex brokers to use.

Headquartered in London, ZFX offers traders several options to trade in different markets like forex, commodities, and cryptocurrencies. It sources the best prices in the institutional marketplace by leveraging cutting edge technology and limiting systematic risk.

How to Trade AUDCHF Now?

Here’s how to start trading the currency pair in just a few easy steps.

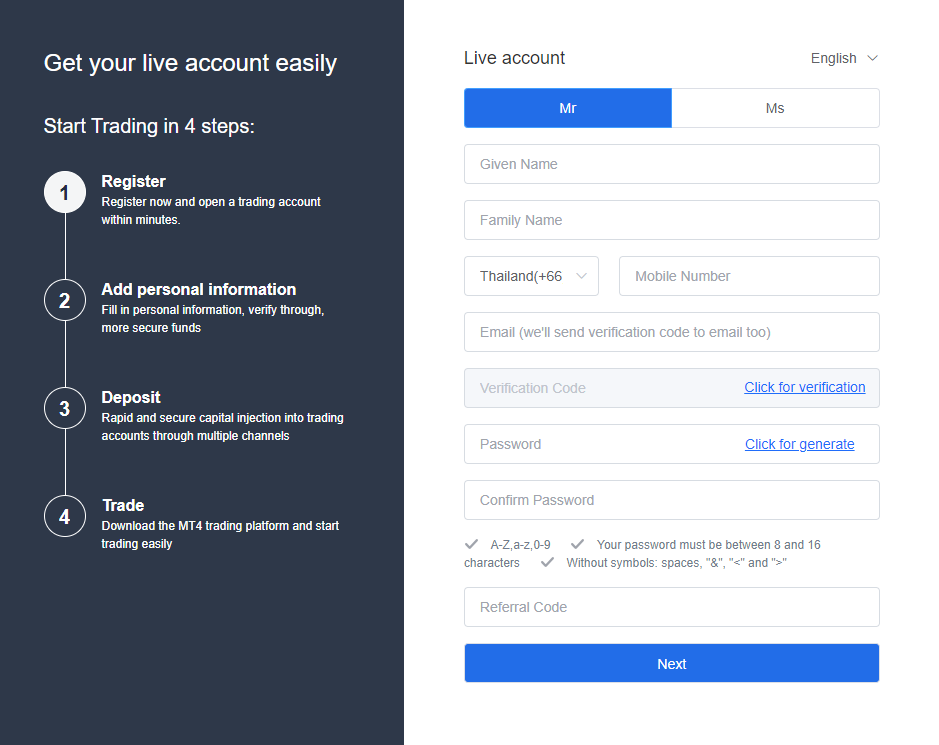

Step 1: Open a ZFX Account

Register on the ZFX platform by submitting your personal details such as full name, mobile number, and email. You should then get a verification code on your registered mobile number to set up your password. After that, choose between the three options: Mini, Standard, and ECN. You can activate your account within minutes.

ZFX also provides a Demo Account option for investors who are unsure about the platform and want to test it out first. This is a trading simulator account that lets you experience the ZFX interface in a risk-free, controlled environment. Once you get the hang of it, you can opt for a Live Account.

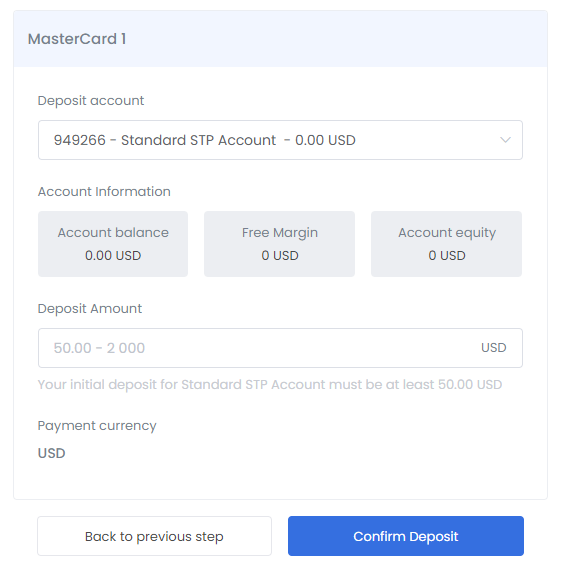

Step 2: Make your First Deposit

Mini trading accounts require a minimum initial investment of $50, while Standard STP Trading accounts and ECN trading accounts have a minimum fund deposit requirement of $200 and $1000, respectively. Based on the nature of the account and investment goals, investors can deposit funds online within minutes. The amount loaded in the wallet can be entirely used for trading, as ZFX does not charge any fee on deposits.

An ECN, or Electronic Communication Network account, is sort of like a closed auction group. It lets traders have direct access to other market participants through interbank trading prices. The spreads here are tighter, and the prices are better, minimizing effective trading costs. This is a more transparent environment for traders.

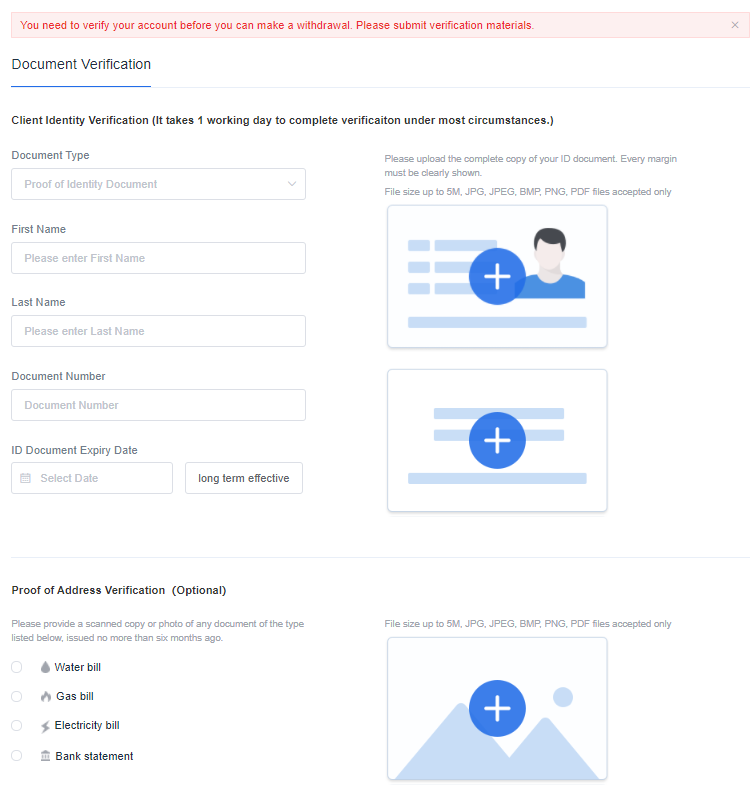

Step 3: Verify your Account

Account verification is the final step, after which you can begin trading. You scan or photograph any of the following documents – A national ID card, driver’s license, or passport and upload the same on ZFX. Also, upload a photo of your bank passbook or a copy of your bank statement. Note that the photo should be the same as the bank account you set up when you opened your trading account with ZFX.

Step 4: Start Trading AUDCHF

Now that you are all set up, you can start trading by downloading MT4 from ZFX. With its powerful analysis tools, a wide variety of instrument options, and fully scalable and mobile compatible programs, MT4 is one of the most popular Forex trading platforms in the world.

Tips for AUDCHF Beginner Traders

As one of the safest currency pairs in the forex markets, trading AUDCHF is pretty easy. However, beginner traders should keep the followings points in mind to maximize their returns.

1. Forex markets are bigger than stock markets

Approximately $5 trillion forex trades are executed each day, much higher than the stock market volume. Multinational banks and governments play a major role in maintaining the stability of this market. Moreover, the markets are open all day during the weekdays, unlike stock markets which are only open for certain hours. As a result, the forex markets are more dynamic. Thus, first movers in such dynamic markets tend to gain manifold. However, this means that investors need to keep track of AUDCHF news constantly.

2. Set stop-loss and limit orders

Though beginners should keep a close on the markets, it is not practically feasible to execute orders at the correct time, which might result in huge losses. However, the stop and limit order features allow investors to place execution orders with their brokers, relieving investors of the headache of monitoring markets constantly.

Bottom Line: Is AUDCHF a Good Investment Now?

Despite being two of the most heavily traded currencies in the world, AUDCHF might witness a slump, due to the rising pressures on Aussie. However, the currency pair might fall by only a few pips at most, as it is one of the most traded derivatives in the forex markets. Moreover, the chances are that the Australian dollar will regain traction as the markets improve in 2022, making the current dip the ideal time to invest in AUDCHF to ensure substantial capital gains.