How to Buy Wells Fargo Stock Now, Forecast and Dividend

Wells Fargo stock is often one of the first choices of investors who want to take advantage of the bullish potential of the U.S. banking sector, especially since it is one of the 3 largest banks in the country. But beyond this advantageous position, Wells Fargo stock has many other advantages and strengths that make it an ideal investment choice for investors of all profiles.

This analysis will review Wells Fargo’s business, recent news, and the historical evolution of its stock price. We will also look at its future prospects, whether from a financial, technical, or analysts’ point of view. Finally, we will introduce you to an online broker that we consider ideal for buying Wells Fargo stock, detailing its strengths and explaining how to buy shares quickly and easily.

Wells Fargo Overview

Wells Fargo is the third-largest bank in the United States, second only to JP Morgan and Bank of America. Founded in 1852 by Henry Wells and William Fargo, it is currently headed by Charles Scharf. As for the most significant acquisitions in its history, Wells Fargo merged with Norwest Corp. in 1998 before buying Wachovia Bank in 2008, which allows it to have 70 million customers throughout the United States.

Wells Fargo‘s business today is divided into 3 main categories:

- Wealth and Investment Management, which caters to a very high-end clientele

- Wholesale Banking, which includes services offered to businesses

- Community banking, which includes retail banking and small business services

Regarding the recent news of Wells Fargo, we note that current events have been rather adverse, with a recent controversial decision to terminate its personal loans business. Moreover, Senator Warren called on the Fed to dismantle the bank recently. She said that the Fed must separate its retail business from its other activities. Otherwise, it will allow “this giant bank with a broken culture to conduct business in its current form poses substantial risks to consumers and the financial system,” according to her.

On the face of it, this is not an encouraging context. However, we will see in the following analysis that many factors allow us to anticipate a bright future for the Wells Fargo stocks. Thus, we can easily imagine that the bearish pressure on the stock that could result from this context could provide an interesting buying opportunity.

Wells Fargo Stock Historical Price and Market Profile

Let’s take a look at the historical evolution of the Wells Fargo stock price. Wells Fargo stock is listed in the United States on the NYSE. It can be found under the symbol WFC or with the ISIN code US9497461015. It is a major component of most major US stock indices, such as the Dow Jones and the S&P 500.

The impressive rebound in Wells Fargo stock price from its lows in the face of the pandemic has allowed it to soar by nearly 90% over the past 12 months. During this period, the stock has traded in a range of $20.76-$51.41.

Wells Fargo Stock Price History

Wells Fargo stock price history goes back several decades, but we will focus on its evolution since the 2008 financial crisis to remain relevant.

As seen on the WFC stock chart, in monthly data, the stock went from around $36 before the financial crisis to a low of less than $8 in early 2009. It was not until the second half of 2013 that the stock returned to its post-financial crisis levels.

After that, it very sharply increased its rise until scoring an all-time high of over $66 in January 2018. Unfortunately, Wells Fargo stock then experienced a two-year decline that culminated in the covid-19 pandemic. As a result, Wells Fargo stocks marked a low at just over $20 in October 2020.

Since then, Wells Fargo has posted a meteoric rise. The Wells Fargo stock price today is $46, so the stock has more than doubled in value in about 7 months. Since April 2021, Wells Fargo stock has paused in its long-term uptrend but is above a long-term support around $44, which greatly limits the downside risk from current prices.

Thus, there is a good chance that the consolidation of the last few months is a breath of fresh air before starting a new multi-year bullish phase.

Why Invest in Wells Fargo Share? Points to Consider

Let’s now look at the benefits of Wells Fargo stock for investors by further examining the strengths of its business, as well as different types of Wells Fargo stock forecast.

Wells Fargo business model

Like most banks, Wells Fargo‘s revenues come mostly from lending activities. In this context, the bank makes money by lending at a higher rate than the one it borrows from the central bank. Thus, the higher the Fed’s key rate, the higher Wells Fargo‘s profits will be for the same margin rate. However, the Fed’s rates have been close to zero for several years now and will finally be raised starting next year.

This means that Wells Fargo‘s profits will mechanically increase over the next few months, which should obviously have an upward impact on its share price.

Wells Fargo stock dividend information

Although the upside potential of the Wells Fargo stock price is undeniable, some investors are most interested in the Wells Fargo stock dividend. The dividend currently represents a yield of 1.7%, which is enough to qualify Wells Fargo as a dividend stock.

But above all, as we have seen above, the inevitable rise in interest rates which should take place in the medium term will allow Wells Fargo‘s profits to increase, which will provide it with enough liquidity to increase its dividend significantly.

Wells Fargo stock forecast and prediction

From a financial perspective, it is worth noting that Wells Fargo has exceeded expectations in terms of earnings per share and revenue for the past two quarters. It is also interesting to note that EPS has increased for the last 4 consecutive quarters. Thus, for the upcoming results due in October, there seems to be a good chance that the consensus EPS and revenue forecasts of $0.99 and $18.21 billion will be exceeded.

Wells Fargo stock forecast, from a technical point of view, allows to clearly spot an uptrend in Wells Fargo stocks since November 2021, as seen on the Wells Fargo stock chart (weekly data).

This uptrend has allowed it to break through a key threshold around $44, which has alternately served as support and resistance since 2013. With WFC still above and near this support, bearish risk seems limited, and Wells Fargo stock price today could be ideal for buying.

Finally, as far as analyst opinions are concerned, 15 analysts recommend buying, 12 have a neutral view, and only 1 recommends selling. These analysts’ average target of $50.15 implies a potential upside of more than 7.5% from Wells Fargo stock price today.

Where Can I Buy Wells Fargo Stock?

There are many brokers in the market, but some are better than others. In the course of our research, we discovered that ZFX is one of the brokers that displays the most significant advantages.

Established in 2018, this broker is relatively new, but that doesn’t take away from its qualities. Speaking about security and regulation, ZFX is a broker regulated by several financial authorities, including the UK FCA.

As far as the trading platform is concerned, ZFX offers the famous MT4 platform, which has been adopted by millions of traders worldwide. This platform offers all the essential tools for traders. It is also known as the best platform for automatic trading. Finally, as far as accessible markets are concerned, ZFX offers to buy stocks, commodities, indices, and forex currency pairs.

How to Buy Wells Fargo Stock Easily

Buying WFC through the broker ZFX is very simple and fast. Indeed, the account opening is done entirely online, and takes only a few minutes. All you have to do is follow these steps:

- Register with ZFX

- Verify your ZFX account

- Make your first deposit

- Buy Wells Fargo stock

Let’s go through each of these steps in detail.

1 – Register with ZFX

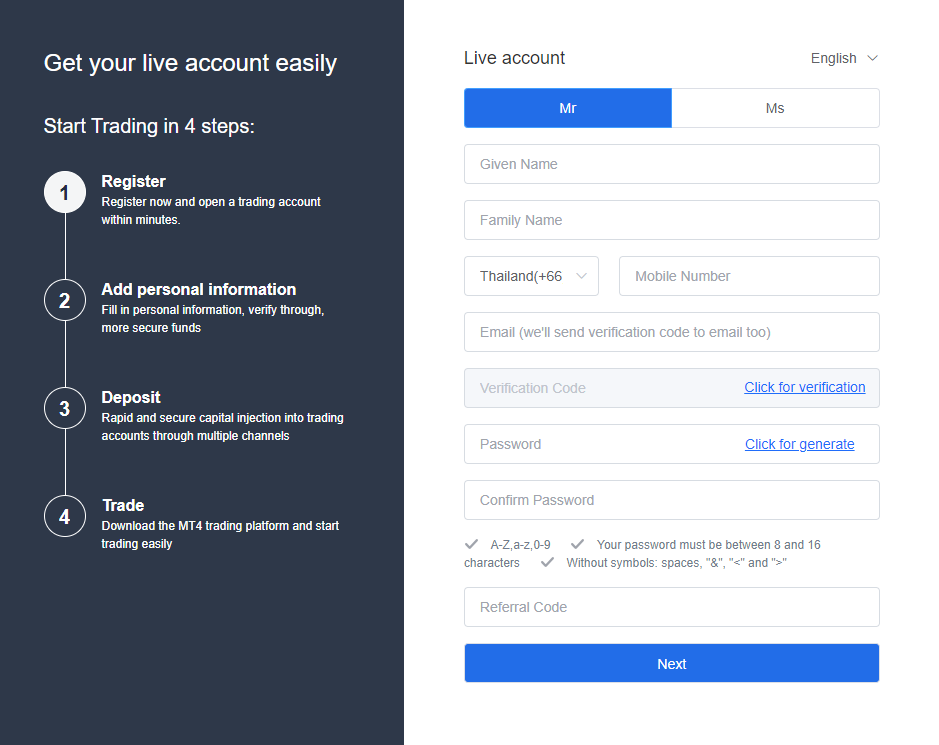

For this first step, you will need to go to the ZFX broker’s website, and click on the “open an account” button. You will then have to fill in a registration form with several personal details, including your phone number, which will be verified by SMS.

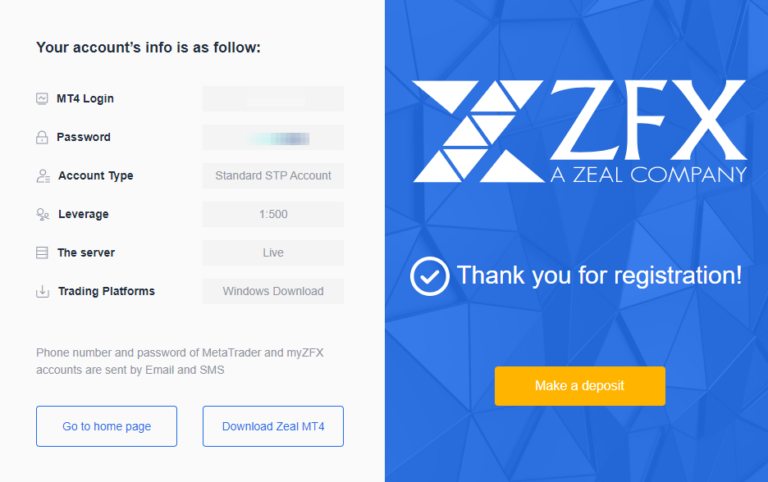

After filling out the form, click on the “next” button at the bottom of the page. Immediately after this step, ZFX will display your MT4 login and password, and invite you to download the platform.

2 – Make your first deposit

You will then be asked to make your first deposit. To do this, you will need to click on the “make a deposit” button on the screen that is displayed immediately after registration.

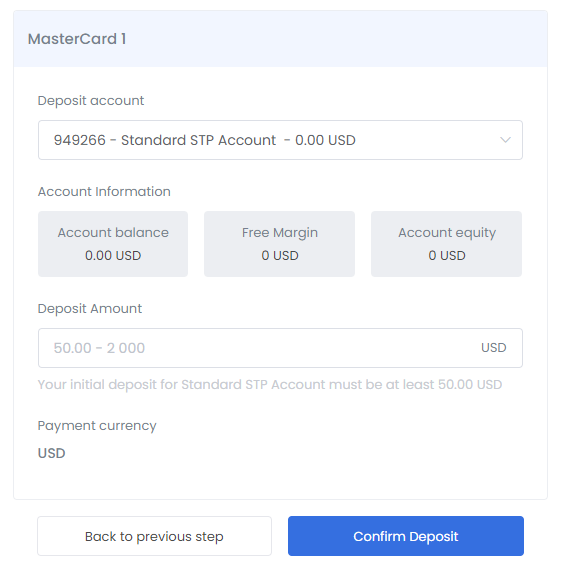

You will then be asked to choose a payment method. Let’s take Mastercard as an example:

On this screen you will be asked to indicate the deposit amount and then click on the “Confirm Deposit” button. You will then be asked for your credit card information before the final validation of the payment.

3 – Account verification

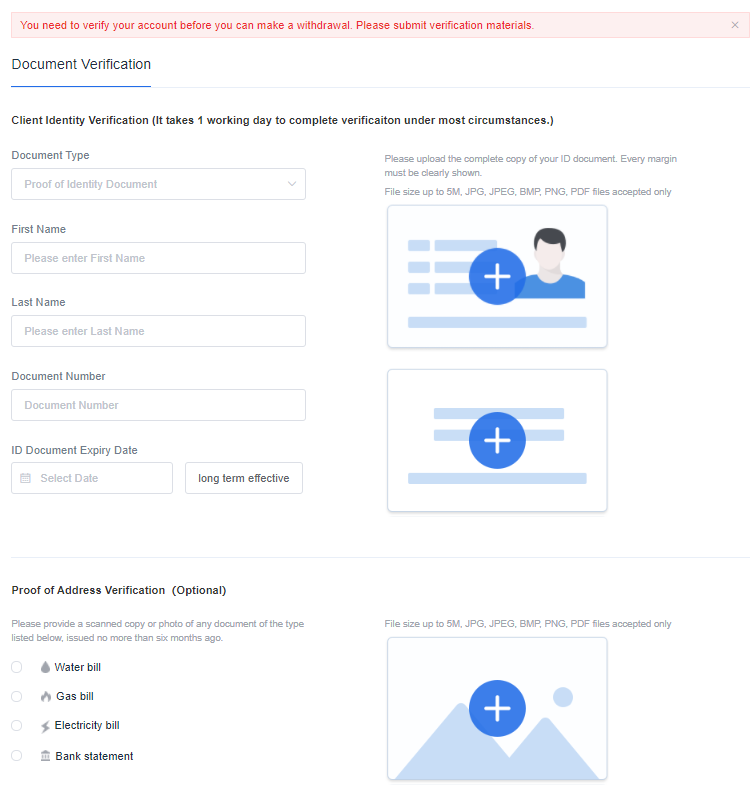

Finally, you need to proceed with the account verification by sending supporting documents.

As shown in the image above, you will need to upload the documents directly to the ZFX website.

4 – Buy Wells Fargo stock

Once your documents are validated, you will then be ready to buy Wells Fargo stock on ZFX, through the MT4 platform that the broker provides for you to download. To buy or sell WFC, you’ll need to set the desired volume, order type, and if you so wish, stop loss and take profit levels.

Bottom Line : Should I buy Wells Fargo Stock today?

Wells Fargo is an exciting stock in many ways, although it is not really a trendy stock. As a bank, it is destined to see its profits soar when the central banks start to raise their key interest rates, which should happen soon. This is the most important fundamental factor in Wells Fargo’s share price.

But it is also a stock that will satisfy income-oriented investors, as it pays a comfortable dividend that should continue to grow. The chart context shows that the stock is near solid long-term support, which a priori limits the downside risk. Finally, most professional analysts recommend buying Wells Fargo stock, which further confirms that it is a wise investment.

If you’ve discovered through this analysis that WFC stocks could be right for you, too, we recommend you check out the broker ZFX. For many of the reasons discussed in this guide, we consider it one of the best brokers to buy Wells Fargo stock and many others.