Hong Kong China H-Shares Index: Share Price, Chart, Forecast

The Hong Kong China H-Shares Index is one of the most popular indices for investors who want to take advantage of the explosive potential of the Chinese stock market without complications. In this analysis, we will provide you with all the details that will allow you to properly approach investing in the Hong Kong China H-Shares Index from its history to its forecasts. We will also show you how to start trading the index.

What Is the Hong Kong China H-Shares Index?

Let’s learn more about the Hong Kong China H-Shares Index is, how it works and its objective.

China H-Shares Index Definition

The Hong Kong China H-shares Index, also known as China H Shares, is an Asian stock market index that gathers the 50 largest companies from mainland China listed in Hong Kong. It is a Free-float-adjusted market capitalization-weighted index, with a maximum limit of 8% per share since June 2021. It is revised quarterly, which means that its composition may change every 3 months, at the end of March, June, September and December.

Hong Kong China H-Shares is one of the most popular indices for international investors who want exposure to China. Investing directly in mainland China markets can be complicated, and this index helps to circumvent this problem.

Hong Kong China H-Shares Index Today and History

The China H-Shares was launched in 1994 and is managed by Hang Seng Indexes. The unique feature of the index at its inception was to focus on H-shares, which are stocks of Chinese companies that are majority-owned by a government entity.

However, since 2018, the Hong Kong China H-shares Index can also accommodate other types of stocks called Red Chips and P chips. Red Chips are shares of mainland Chinese companies at least 30% owned by the Chinese government. P-chips are shares of mainland Chinese companies that are neither H-shares nor Red-chips.

China H-Shares Price Evolution

Let’s now study the historical evolution of the China H-Shares, which will allow us to identify the main phases of its evolution.

Hong Kong China H-Shares Chart

We will base our observations on the monthly Hong Kong China H-shares Index chart below, focusing on the evolution of the index since 2000.

The Hong Kong China H-Shares Index was around 2,500 points in 2003, before starting the most powerful bull run in its history. It reached an all-time high of over 20,500 points in 2007, after a 720% rise in about 4 years. The 2008 financial crisis caused the index to plunge, as did all global indices. It reached a low of 4,790 points that October, down over 75% from its all-time high.

Since then, it has traded between 8,000 and 15,000 points. The fact that the Hong Kong China H-shares Index is currently close to the lower bound of this 10-year channel. This suggests the index may soon enter a bullish phase that could last several months.

What Influences the Price of Hong Kong China H-shares Index?

Here are the main factors that influence the Hong Kong China H-shares Index price:

- Chinese economic activity and statistics such as GDP clearly influence China H-Shares. Since the index is a collection of Chinese stocks, growth in China is mechanically beneficial to them. Traders should thus closely follow China’s top economic indicators.

- International Trade Agreements: China is a country whose economy relies heavily on exports. Thus, trade agreements with other regions or simply geopolitics can also influence the Hong Kong China H-shares Index price. For example, in 2018-2020, the index suffered from the tariff war between China and the US.

- News of the top companies in the index: As a weighted index, some stocks have more influence on the index price than others. For example, the top 5 stocks account for 10% of the total stocks in the index, but account for more than 37% of its capitalization. Thus, news such as the quarterly results of these companies can directly impact the index price.

The Hong Kong ChinaH Shares Companies and Components

The Hong Kong China H-shares includes world-renowned companies. Its top 5 stocks are:

- Alibaba: 10.1%

- CCB: 7.8%

- Meituan: 7.4%

- Tencent: 7.1%

- Xiaomi: 5.2%

As for the sectoral breakdown of the Hong Kong China H-shares Index, we can see that technology dominates, as you can see with the top 5 sectors breakdown of the index:

- Technology: 36% (9 stocks)

- Financials: 27% (10 stocks)

- Consumer Discretionary: 9% (5 stocks)

- Properties & Construction: 7% (10 stocks)

- Consumer Staples: 5% (4 shares)

How are the China H-shares Index companies chosen?

For a stock to be eligible for the index, it must:

- Be a share of a Mainland China company

- Be at least 1 month old

- Have a minimum velocity of 0.1% on a monthly basis

- Then, to select the 50 stocks that make up the index, Hang Seng Indexes ranks the eligible stocks according to the “MV Rank”.

- The market value (“MV”) of eligible stocks refers to the average market value of the past 12 month-ends of any review period. For a stock with a history shorter than 12 months, the MV refers to the average of the past month-ends since the securities listed. The MV is then sorted in descending order to get the MV Rank.

Hong Kong China H-Shares List of Stocks

Find below the list of the 20 most important China h-shares index constituents.

|

Companies |

Ticker |

Sector |

| Alibaba | 9988 | Technology |

| China Construction Bank | 0939 | Financials |

| Meituan | 3690 | Technology |

| Tencent | 0700 | Technology |

| Xiaomi | 1810 | Technology |

| Ping An | 2318 | Financials |

| ICBC | 1398 | Financials |

| China Mobile | 0941 | Telecommunications |

| CM Bank | 1723 | Financials |

| BYD Company | 1211 | Consumer Discretionary |

| Bank of China | 3988 | Financials |

| Anta Sports | 2020 | Consumer Discretionary |

| Sunny Optical | 2382 | Industrials |

| Geely Auto | 0175 | Consumer Discretionary |

| JD | 9618 | Information Technology |

| Kuaishou | 1024 | Information Technology |

| CNOOC | 0883 | Energy |

| Mengniu Dairy | 2319 | Consumer Staples |

| ENN Energy | 2688 | Utilities |

| SMIC | 0981 | Information Technology |

As said before, this China H Shares list shows how much the index is dominated by the information technology sector.

Should I Trade the Hong Kong China H-Shares? Points to Consider

Before you start investing in the China H-shares Index, you should learn about its features to confirm that it is right for you.

- The average volatility of the HK China H-shares Index is slightly higher than that of other major stock indices, because the Chinese economy is still developing. This will be especially appreciated by short-term traders, who will have opportunities available to it each day.

- The Hong Kong China H-shares Index is considered by many experts to be the default choice for investors who want to gain exposure to the Chinese markets.

- Including only 50 stocks from leading companies, it is unlikely to see their stock – and thus the index – collapse completely.

- The index is easily accessible via online brokers such as ZFX, where you can trade the Hong Kong China H-shares Index via CFD. This allows for leverage, allowing for a downside bet on the index.

- There are other ways to invest in the index, such as China H Shares futures or China H Shares ETF. However, they are generally more expensive and less convenient than CFDs.

Where Can I Trade China H Shares Index?

ZFX is one of the best brokers to buy Hong Kong China H-shares Index. ZFX is a regulated and comprehensive broker offering many advantages. For example, it provides its clients with the MT4 trading platform, which is the most widely used globally thanks to its many technical analysis and automated trading advantages. Moreover, the broker offers stocks, indices, forex and commodities.

How to Trade the Hong Kong China H-shares Index Easily

Buying Hong Kong China H-shares Index through ZFX is simple and fast. The account opening is done entirely online, and takes only a few minutes. All you have to do is follow the next steps.

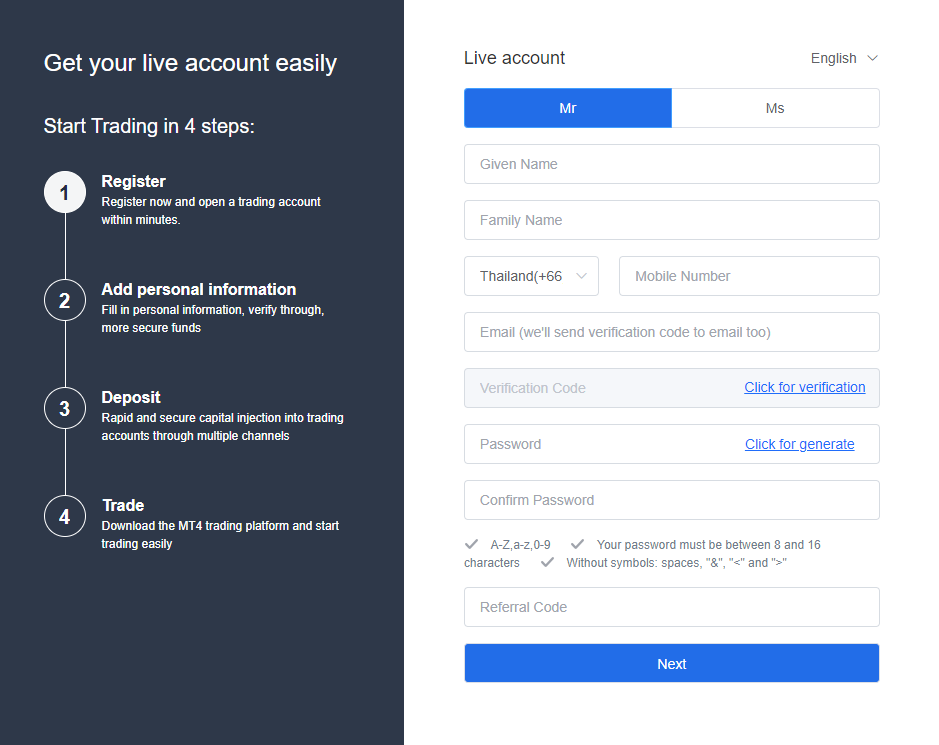

1 – Register with ZFX

First, go to the ZFX website and click on “Open an account”. A registration form will appear; fill it in with your personal details. Note that your phone number will be verified by SMS.

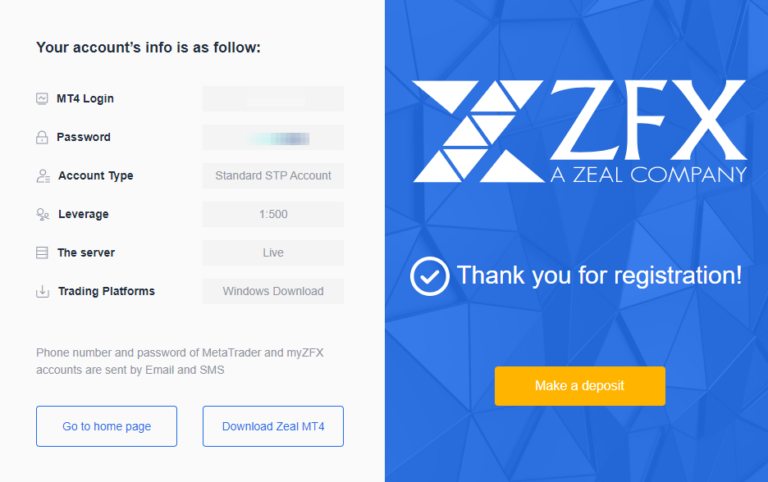

Then, click on “Next” at the bottom of the page. Immediately after this step, ZFX will display your MT4 login and password, and invite you to download the platform.

2 – Make your first deposit

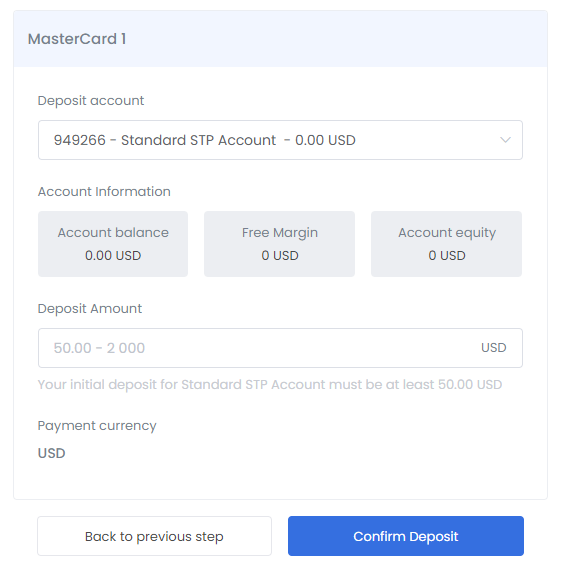

To do this, you will need to click on “Make a deposit” on the screen displayed immediately after registration. You will then be asked to choose a payment method.

On this screen, indicate the deposit amount and then click on the “Confirm Deposit”. You will then be asked for your credit card information before the final validation of the payment.

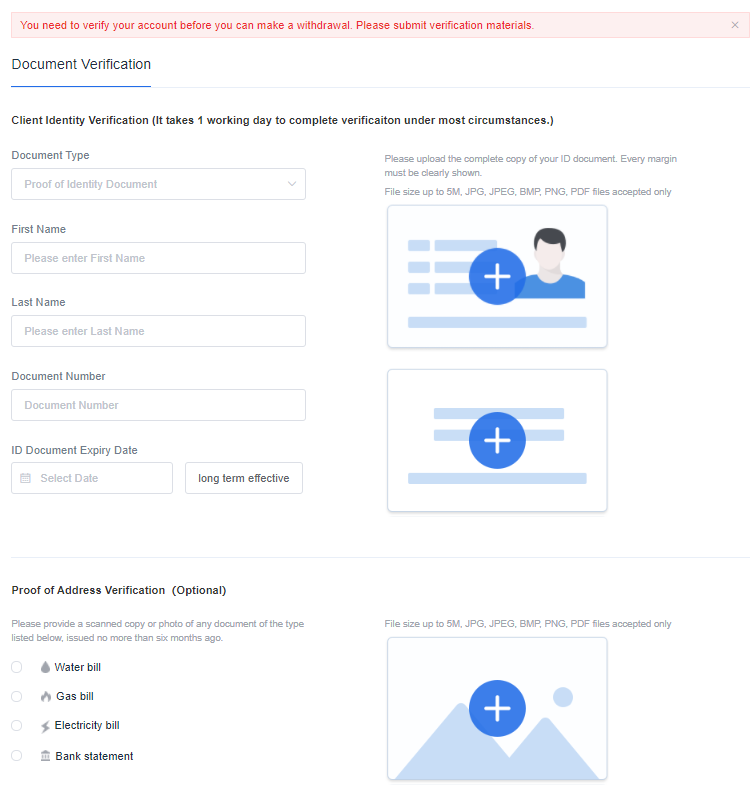

3 – Account verification

Finally, you’ll need to proceed with the account verification by sending supporting documents.

As shown in the image above, you will need to upload the documents directly to the ZFX website.

4 – Buy China H-shares Index

Once your documents are validated, you will then be ready to buy Hong Kong China H-shares Index. To do so, download the MT4 platform and access it using your MT4 login details. You will then be able to trade China H and many other assets as you wish.

Thing to Know Before Investing in Hong Kong China H-Shares

As this guide draws to a close, we want to provide you with some tips to help you succeed in trading Hong Kong China H-Shares.

- While there are fewer sources of information about Chinese stocks than about US or European ones, they do exist. So before you start trading China H, find a reliable source of information to keep updated with the latest news in the Chinese financial markets.

- The medium-term direction of the China H Index depends on economic and financial factors, its short-term evolution depends more on the chart context and technical thresholds. So if you plan to trade the index in the short term, make sure to learn the basics of charting and technical analysis.

- With most quality brokers, like ZFX, you can their trading platform for free via a demo account. You can practice thus trading without any risk of losing money and develop your trading strategy before entering the real market.

- Follow a strict trading method when trading Hong Kong China H-Shares. These include the types of signals you will take into account, risk management, stops and limits… Without a method, trading is a matter of chance, so all traders need to define their trading method and follow it scrupulously.

- Finally, remember the index allows you to invest in Chinese stocks, a market considered riskier than US or European markets. Therefore, it is wise to diversify your investments outside the China H-Shares Index with US or European stock indices.

Hong Kong China H-Shares Index Future, Forecast and Predictions

Let’s now studying the Hong Kong China H-Shares Index forecast. For this, we will rely on analysts’ opinions, the economic context, and technical analysis.

Recommendations and Forecast of Analysts

Few analysts officially publish regular Hong Kong China H-shares Index forecasts. However, you can get analysts’ opinions for the stocks in the index. For example, for the largest stock in the index, Alibaba stock, analysts have a strong bullish view. Out of the 26 professional analysts who follow the stock, 23 recommend buying, 2 are neutral and only 1 recommends selling.

More importantly, the average analyst target for Alibaba stock is $246 for the U.S.-listed stock, implying a potential upside of more than 75% from the current price. The most bullish analyst for Alibaba stock, Vincent Yu of Needham, even has a $330 target, implying a potential upside of more than 135%.

Hong Kong China H-Shares Fundamental Perspective

The Chinese economy is still expected to evolve significantly over the next few years. And even though double-digit growth rates are probably no longer to be expected, there is a good chance that Chinese growth will remain higher than that of Europe or the US over the next few years, which could lead to an outperformance of Chinese stocks and, therefore of the China H-shares.

China H-Shares Index Technical Analysis

Let’s analyze the HK China H-shares Index forecast from a technical perspective.

This Hong Kong China H-shares Index chart shows that after peaking at 12,255 points in February 2021, it posted a sharp decline to around 8,500 points at the beginning of Q4 2021. This is a 30% drop in about 6 months.

However, this fall brought the Hong Kong China H-shares Index back to a long-term support zone, the 8000/8500 points area, which had, by the way, stopped the plunge posted in the face of the covid-19 pandemic in March 2020.

In this context, the most likely next step for the China H-shares is a rebound from this significant support. The major psychological threshold of 10,000 points and last year’s high above 12,250 points will be the first medium-term targets to watch. Therefore, this could be an excellent time to buy Hong Kong China H-Shares.

Bottom Line: Is Hong Kong China H-Shares a Good Investment Now?

The Hong Kong China H-shares Index is an attractive investment in many ways, not least because it is the most convenient way to invest in Chinese stocks. It allows investors to diversify geographically and gain exposure to Chinese stocks’ high earnings potential.

In addition, the outlook is particularly favorable, with the Chinese economy expected to continue to keep growing. Analysts are also optimistic about the major stocks that make up the index. Furthermore, the recent drop in the Hong Kong China H-shares Index to multi-year support provides an ideal opportunity for a medium-to-long-term buy.

If you would like to take advantage of the potential of the China H-shares Index, you can invest via ZFX today. Indeed, this broker has many advantages that make it one of the best brokers for trading and investing in the China H Shares and many other indexes.