DAX 40 (ex DAX 30): Share Price, Chart and Forecast

The German economy is one of the strongest in the world and for good reasons. In addition to a high export quota, other factors contributing to the nation’s success include an excellent employment rate, strong economic centers, the best trade fair location, a high-performing medium-sized enterprise, an open economy, and the critical role of industry. With that in mind, if you’d like to invest in the nation, one of the easiest and quickest ways to do so from anywhere in the world is to invest in German Stocks. That’s why today’s guide has been dedicated to one of Germany’s most impressive investment vehicles, i.e. the DAX 40 Index (formerly the DAX 30 Index.)

What is the DAX 40 (ex DAX 30) Index?

The DAX 40 Index is one of the most important and followed indicators of Germany’s economic health. Let’s learn about the Index’s history, where it stands today and where it might be heading in the future.

DAX 40 Definition

The DAX 40 (Deutscher Aktien IndeX) is a stock index of the 40 largest blue-chip German companies trading and listed on the Frankfurt Stock Exchange. Just like the S&P 500 or FTSE 100, the DAX 40 is a capitalization-weighted index, meaning it essentially tracks the performance of the 40 biggest publicly traded companies in Germany.

DAX 40 Index Today and History

Over the decades, its historical data has established the DAX to be unpredictable, thanks to its frequent membership changes, industry composition, and sheer size.

DAX 40 Dropouts

The DAX 40 index is an exclusive club that only the most dynamic, prosperous, and largest German firms are allowed to join. Due to the Index’s extremely high standards of membership, it’s no surprise that lots of companies have fallen out of the exclusive club over the decades that the DAX 40 has been in existence. Some of the biggest DAX 40 dropouts from the last several decades include ThyssenKrupp, Salzgitter, Hannover Re, Deutsche Postbank or Epcos.

DAX 40 Takeovers and Mergers

The German corporate realm has an extensive and documented history of takeovers and mergers that have seen some of the largest DAX 40 companies pooling together to truly become global giants.

Some of the most significant takeovers and mergers to ever take place on the DAX 40 index:

- Bayer’s takeover of Schering, the pharma firm best known for creating aspirin (2006)

- Allianz’s takeover or Dresdner Bank (2001)

- Chrysler merged with Daimler, the largest industrial merger in history at that time (1998)

- Nixdorf AG merged with Siemens’ Computer and DIS division (1990)

DAX 40 Today

Before September 20, 2021, 30 companies formed the DAX index, hence it formally referred to as the DAX 30. However, on September 20, 2021, ten more companies joined the DAX index. At the stock market opening at 9:00 am in Frankfurt that day, the new entrants turned the DAX 30 into a DAX 40. The new entrants include Airbus, Porsche, Puma, Siemens Healthineers, Symrise, Sartorius, Brenntag, Hellofresh, Qiagen and Zalando. This has been dubbed the most extensive facelift in Dax’s 33-year history.

Shortly after the Covid-19 pandemic hit, the DAX 40 suffered a turbulent period that saw national carrier Lufthansa drop out of the list due to pressure from the pandemic. In this same time frame, the Index also experienced the collapse of one of its constituents, Wirecard, after revelations of large-scale fraud by the payments company. In an effort to counter the bad press, DAX 30 decided to restructure itself into a format that looks “More attractive.”

Additions to DAX 40’s lineup are also meant to better reflect the transforming German economy, explaining the inclusion of firms like the meal kit supplier HelloFresh and tech firms like Zalando. Both of these companies benefited massively from people working from home after the outbreak of the pandemic.

The DAX40 Price Evolution

Since DAX 40’s first introduction in July 1988 in Frankfurt, its progression and performance have experienced lots of ups and downs. This section of the guide has been dedicated to that history.

DAX 40 Price Chart

Our analysis of DAX 40’s chart performance begins in 1995. The DAX 40 Index (then known DAX 30) posted huge gains at the time, thanks to U.S. tech stock valuations pushing stocks higher.

Between 1995 and 2000, the DAX 40 gained over 300 percent, skyrocketing from 2,000 points to a record high of 8,000 points. Over the next seven years, DAX 40’s price action moved in a V-shaped manner, plunging in 2003 to 2,200, before spiking again and matching the previous 8,000 high in 2007.

When the global housing crisis hit in 2008, it facilitated a second pullback that saw the DAX 40 drop to 3,800 points by Feb 2009. From there, the DAX 40 led a consistent uptrend with three slight corrections in 2018, 2015, and 2011.

Before the Coronavirus pandemic hit in 2020 and triggered one of the fastest stock market selloffs in history, the DAX 40 Index’s price action was trading at record highs. In response to the pandemic, the DAX 40 price’s dropped 40 percent in just four weeks, going from trading at 13,500+ points to 8,250 points.

The 2020 dip didn’t last long, however, because the DAX 40 rebounded shortly after that and hit the previous record high of just above 8,000 points. By June 2021, the DAX 40 had recovered all losses and was trading above 15,500 points.

What Influences the Price of DAX 40 Index?

Lots of different factors can act as potential price movers of this index. Here are several factors you should always consider before trading the DAX 40.

- Socio-Political events: Events like the coronavirus pandemic, the great recession, and Brexit boast the ability to hit market demands in more ways than one.

- Individual company performance: Firms weighted the highest in the DAX 40 can move the Index significantly. For example, after SAP suffered a 20 percent dip in October 2020, the Index fell 2.6 percent.

- Exchange rates: The euro’s movement against other currencies has widely been considered DAX 40’s key influencer. For instance, as the USD strengthens against the euro, exports from Germany to the US (paid in USD) will be worth more when converted. This boost’s the profit margins of German companies, which, in turn, boosts confidence in the DAX 40 index.

How Does DAX 40 Reacts to Stock Market Crashes?

Let’s take a look at the Index’s performance during the 2008 market crash as an example. The 2008 great recession was the most severe economic crash the world has seen since the 1930s Great Depression.

Germany was also hit particularly hard, despite the considerable government bailouts aimed at saving German banks. The bailouts are estimated to have cost approximately €500 billion.

Between 2007 and the end of 2008, the DAX 30 Index plummeted 55.9 percent and bottomed out at 3,585 points. Even worse, several firms occupying prominent positions on the Index either went bust due to the crisis or exited the DAX 40 Index for good. What does this teach us? That even the great DAX 40 Index isn’t immune to some of the worst stock market crashes.

The DAX 40 Index Companies and Components

Companies in the DAX 40 belong to a wide array of industries, including communications, consumer discretionary, energy, information technology, real estate… For a firm to be considered for inclusion in the DAX 40, first, it must be listed on the Prime Standard, which is Frankfurt’s Stock Exchange. Second, a minimum of 10 percent of the firm’s shares need to be held in public hands.

If a company becomes insolvent or falls to 40th or lower in terms of market cap in the Frankfurt Stock Exchange, it automatically drops out of the DAX 40. Conversely, companies that rise to 25th or higher automatically qualify for inclusion in the DAX 40. The Board of the Deutsche Borse meets each quarter to determine the exclusion and admission of companies into the DAX.

Today, all firms that hope to join this exclusive club will need to demonstrate operating profits from the last two years. To understand how strict this rule is, note this – most of the current DAX 40 companies wouldn’t have passed the rule had it been implemented before they had joined the Index.

DAX 40 List of Stocks

| Company | Ticker |

Sector |

| SAP | SAP | Technology |

| Linde | LIN | Basic Materials |

| Siemens | SIEGY | Industrial |

| Volkswagen (VW) | VOW3.DE | Automaker |

| Merck KGaA | MRK.DE | Healthcare |

| Airbus | AIR | Aerospace |

| Deutsche Telekom | DTE.DE | Communications |

| Allianz | ALIZF | Finance |

| Daimler | DAI.DE | Automaker |

| Deutsche Post | DPW.DE | Industrial |

| Siemens Healthineers | SEMHF | Technology |

| Adidas | ADDDF | Sportswear |

| BASF | BFFAF | Basic Materials |

| BMW | BMW.DE | Automaker |

| Infineon Technologies | IFX.DE | Technology |

| Bayer | BAYZF | Healthcare |

| Sartorius | SRT.DE | Lab Equipment |

| Munich RE | MUV.VI | Finance |

| Henkel | HELKF | Consumer Goods |

| Vonovia | VNA.DE | Real Estate |

| Delivery Hero | DHER.F | Food |

| E.ON | EOAN.DE | Utilities |

| Fresenius | FRE.DE | Healthcare |

| Deutsche Borse | DBOEF | Finance |

| Porsche | PAH3.DE | Automaker |

| Beiersdorf | BEI.DE | Consumer Goods |

| Zalando | ZAL.DE | Fashion |

| Deutsche Bank | DB | Finance |

| RWE | RWE.DE | Utilities |

| Continental | CON.DE | Automotive |

| Deutsche Wohnen | DWNI.DE | Real Estate |

| Fresenius Medical Care | FMS | Healthcare |

| Symrise | SYIEF | Fragrance |

| HelloFresh | HFG.DE | Food |

| Puma | PMMAF | Sportswear |

| HeidelbergCement | HEI.DE | Basic Materials |

| Brenntag | BNR.DE | Chemicals |

| Covestro | 1COV.F | Basic Materials |

| Qiagen | QGEN | Genetics |

| MTU Aero Engines | MTX.DE | Industrials |

Should I Trade the DAX 40? Points to Consider

As you prepare to start investing in the DAX 40 Index, here are some points to consider.

- The Index’s Popularity

The DAX 40 is oftentimes more volatile than the wider equity index, and this explains its popularity among traders. The index is also popular thanks to its excellent exposure to leading companies, great liquidity, and the fact its stocks are highly international (most of its companies derive their earnings globally.)

- DAX 40 Dividends

The DAX 40 dividends are reinvested in the Index itself, which will be reflected in its price. So, as a DAX 40 trader, you’ll not receive any dividend.

- Leverage

While this carries many risks, retail and institutional investors tend to spread bets on the DAX 40. As a derivative, spread betting will not allow you to own the underlying asset. It’ll instead allow you to speculate on whichever direction you think the price will move going forward.

How Can I Trade the DAX 40 Index (GER40)?

How do I put money in the DAX 40 Index? The first thing you’ll need to do is pick the best trading platform. The best trading platform will not only be secure and easy to trade with, but it will also offer faster transactions, learning resources, market signals, permit you to trade DAX 40 in real-time… With all these advantages in mind, ZFX is a broker fulfilling as these criterias.

Here is a step-by-step guide on “how to register an account with ZFX and start trading the DAX 40 Index.”

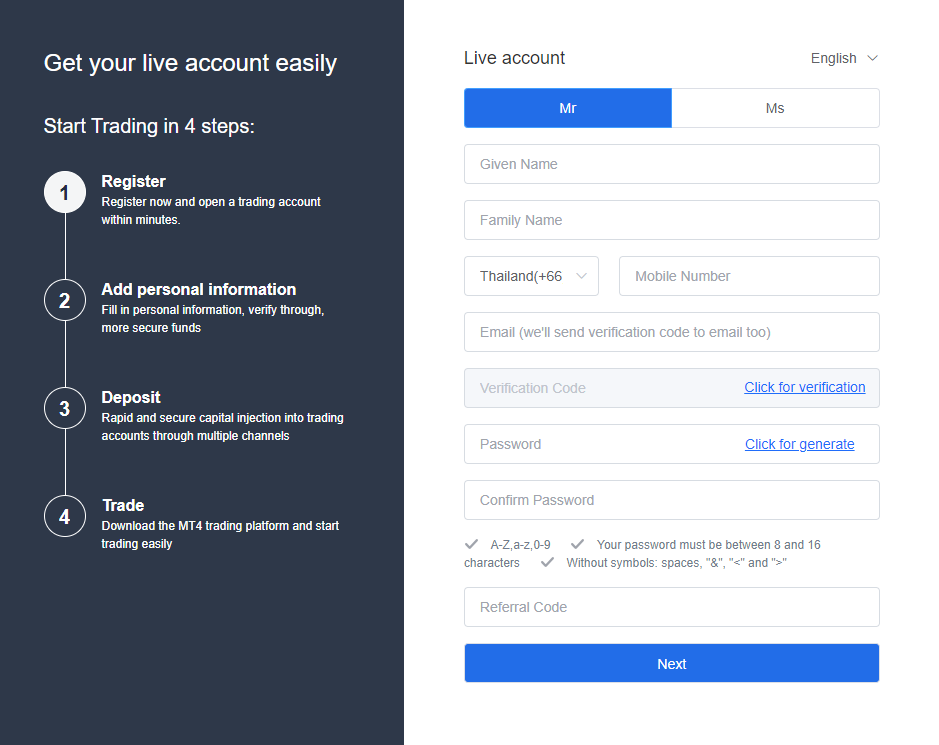

Step 1: Open an Account with ZFX

First, go to ZFX’s homepage. Click “Open an account” to get started right away.

Note that you can also start with a demo account, by clicking “Try Demo”. This will allow you to learn all these without having to risk your real cash.

You’ll then be redirected to a page where you’ll enter your name, mobile number, email address and password. The, hit the “Next” button. A verification code will be sent to your phone.

That should direct you to the page above, where you’ll need to select your account type and country of residence and tick a box if you agree with ZFX’s terms and agreement. After making your choices, hit the ‘sign up now” button at the bottom right corner. Save the MT4 login code and password showcased on your screen in a safe and private place.

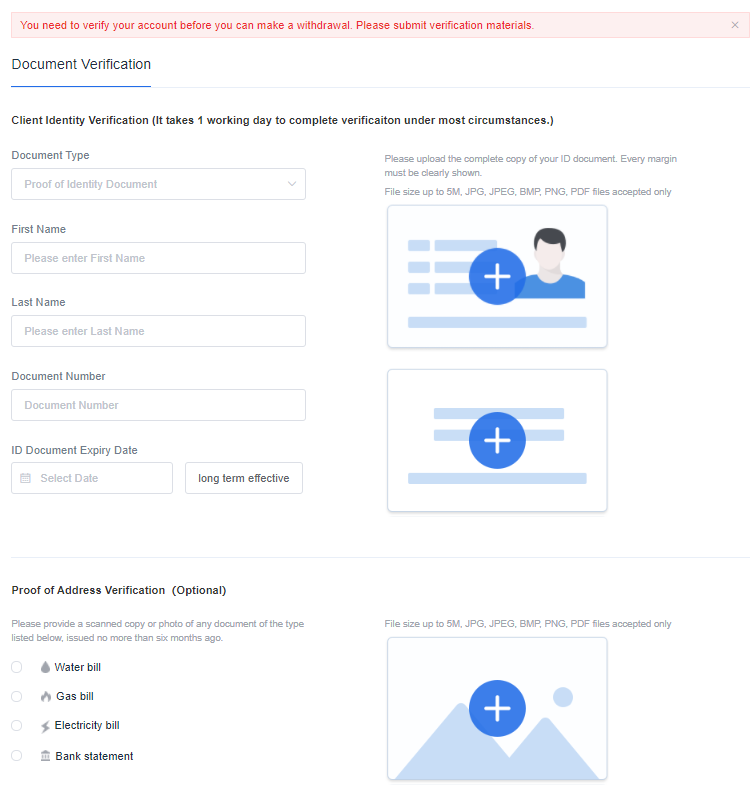

Step 2: Verify Your Account

ZFX will require you to verify your identity before you trade DAX 40. To verify, click on ‘Personal information’ from the list on the left side of your profile dashboard. Then, choose the “Document Verification” option. Submit the needed documents and ZFX will take a day or two to verify your identity.

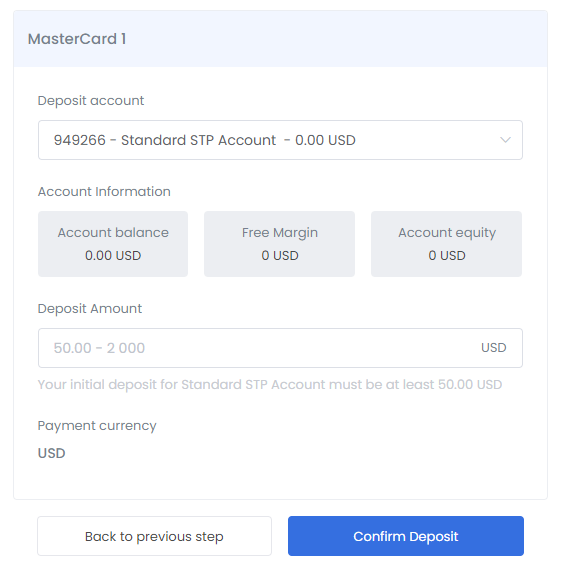

Step 3: Fund Your Account

Your real account need funds before you can use it to trade.

To fund your account, find the “Deposit” link at the top of the page as shown in the image above and click on it.

Step 4: Start Trading on the DAX40 (GER 40)

It’s not time to get trading. Hit the “Download MT4” button next to the “Deposit” icon and install it on your computer. MT4 is the platform supported by ZFX, and the link at the top of the page should allow you to download it as a desktop app for Mac or Windows computers. A mobile trading option for iOS and Android users exists as well.

Once the MT4 app is installed on your device, log into your account using the login details. You can now start trading the DAX 40 Index, which you’ll find under the GER30 symbol.

Tips and Things to Know Before Investing in the DAX 40 Index

In order to trade the DAX40 efficiently, here are a few things to keep in mind.

- Know the top five DAX40 companies

The top five firms of the DAX 40 index make up more than 40 percent of the Index. Thus, when trading the DAX 40, you must track and see how these firms are performing.

- How to trade the DAX 40 index

There are many different ways to the DAX 40. The most common are DAX 40 ETFs, options, CFDs, and DAX 40 futures. Make sure you choose the vehicle which suits you best.

- Know the DAX 40 market hours

DAX 40 Index’s market hours are between 9:00 am and 5:30 pm CET. That said, out-of-hours prices are also calculated through the early DAX (8 am-9 am CET) and late DAX (5:30 pm-10 pm CET.)

- Choose your DAX 40 trading strategy

Traders have different trading strategies, the general consensus is that the DAX 40 Index is best suited for day trading. Investors can use swing trading (momentum), breakout, as well as intraday trend following strategies with CFDs.

DAX40 Index Future, Forecast, and Predictions

Recommendations and forecasts of analysts

John Woolfitt, Atlantic Capital Markets’ director of trading, had the following to say about the recent changes made to the former DAX 30; “These are much-needed and long-awaited changes to the DAX 30 that’ll go some way to modernizing Germany’s most traded stock index, boosting its appeal.”

Patrick Reid, from Adamis Principle, thinks that “The expansion will have a soothing effect on volatility but may put off those with a bigger risk appetite. It’ll be a great thing long term and should attract more long term investors and traders.”

Analysis of DAX 40 from a fundamental perspective

As of Sept 2020, the DAX40 RSI (relative strength index) has been showcasing a bearish divergence, suggesting that higher moves are losing momentum. It’ll take a move below 15,400 points for sellers to gain traction and send the stock back to 15,000. 15,000 is the critical psychological level.

According to a macro model compiled by Trading Economics, the DAX 40 could weaken if it hits the 15,000 points level. If that happens, the DAX 40 is predicted to keep declining toward 14,000 points by June 2022.

DAX40 main support and resistance levels

The DAX 40 keeps getting rejected by the 16,000 points level, despite multiple attempts in the past to break through the point and aim for new all-time highs. The stock price has been consolidating around the 15,700 points mark for a couple of weeks now.

After the Index’s transformation from DAX 30 to DAX 40 at the beginning of Sep 2020, the stock index has found support on the 100 days SMA (simple moving average) and has also attempted to reclaim the 50 days SMA.

Bottom Line: Is the DAX 40 a Good Investment Now?

Yes! It is. Following the DAX 40 Index’s struggle to break through its all-time high, it’s understandable that some traders and investors are turning cautious in the short term. Still, though, the consensus view on the DAX 40 is still consistent with the stock index’s longer-term, more bullish narrative. Even some of the most pessimistic analysts are maintaining their buy ratings on the stock after the recent restructuring.

If you’re ready to invest in the DAX 40, you can do so through ZFX. It is a reliable and efficient broker to trade the index, as well as many other popular international assets.