What is Slippage and How to Prevent it?

The forex market, like most financial markets, is volatile and can change at the drop of a dime, keeping every trader on the edge of his seat. However, that’s not necessarily a bad thing. If the price is too small or even fixed, there is no room for profit. A trader is not afraid of volatility, but what he fears most is the “slippage” that often accompanies volatility. In this article, ZFX will explore the causes of slippage and ways to reduce slippage.

What is slippage?

When an order placed by a trader on a trading platform triggers a transaction order, such as a market order, a stop-loss order, or a limit order, the platform will throw the order to market. If the market price changes at that moment, according to the general transaction logic, the transaction will be completed at the best and latest price. The price of the transaction is often slightly different from what the trader expects, and this difference in price is known as the “slippage” in the forex market.

Is slippage normal?

Slippage is a normal phenomenon in trading. It is mainly caused by the inconsistency between the price set by the trader’s order and the market price at that time when the market fluctuates, especially when the market goes up and down rapidly.

Why is there a slippage?

In the forex market, under normal market conditions, there is no obvious slippage problem 99% of the time. So why does it happen? There are three reasons for slippage:

A. Network delay

Intuitively, it is the speed at which trading platforms execute. Typically, traders receive quotes from various providers of liquidity in the market, which are then displayed on their trading platforms. When the market hits the price of the trader’s order (whether it’s a market order, a stop-loss order or a limit order), the platform sends out the order. There must be a data transmission time (in milliseconds), and this time always produces a slight error.

Throughout the process, there is always a delay, whether it is the transfer between the trader and the platform or the platform and the market, or the processing on the hardware such as the server. In particular, when market fluctuations occur, the so-called “network congestion” may also occur when multiple orders are matched at the same time, resulting in the delay of the transaction time and the difference between the final executed price and the price traders expect.

B. Market volatility

When market prices fluctuate greatly, the frequency of slippage will be very high. Some sudden news, such as the occurrence of major events, or the release of important economic data, would cause the volume of trading in the financial market to plunge, leading to the widening of market spreads and more fluctuations in price trends. At this time, the trader’s order usually cannot be closed at the expected price, because the price has already changed in a relatively short period of time, or because of insufficient volume.

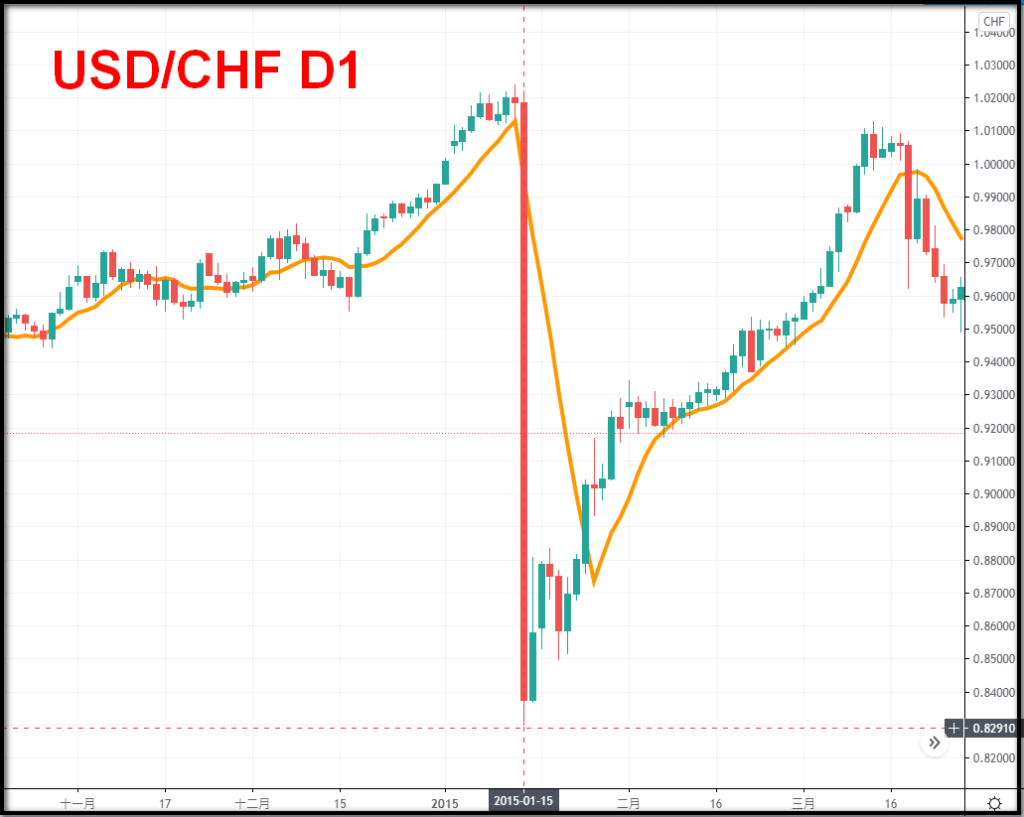

Figure 1: Market fluctuation caused by Swiss Crisis on January 15, 2015

C. Market gaps

Sell-offs often occur during the opening hours of trading on Monday, because some important economic data or heavy news may be released at the weekend, which won’t be reflected in the price until the opening of the market on Monday. If the trader’s order price, such as the exit price of a stop-loss order, is within the gap, a slippage will occur in the final executed price, which will deviate from the preset price because there is no transaction within the gap.

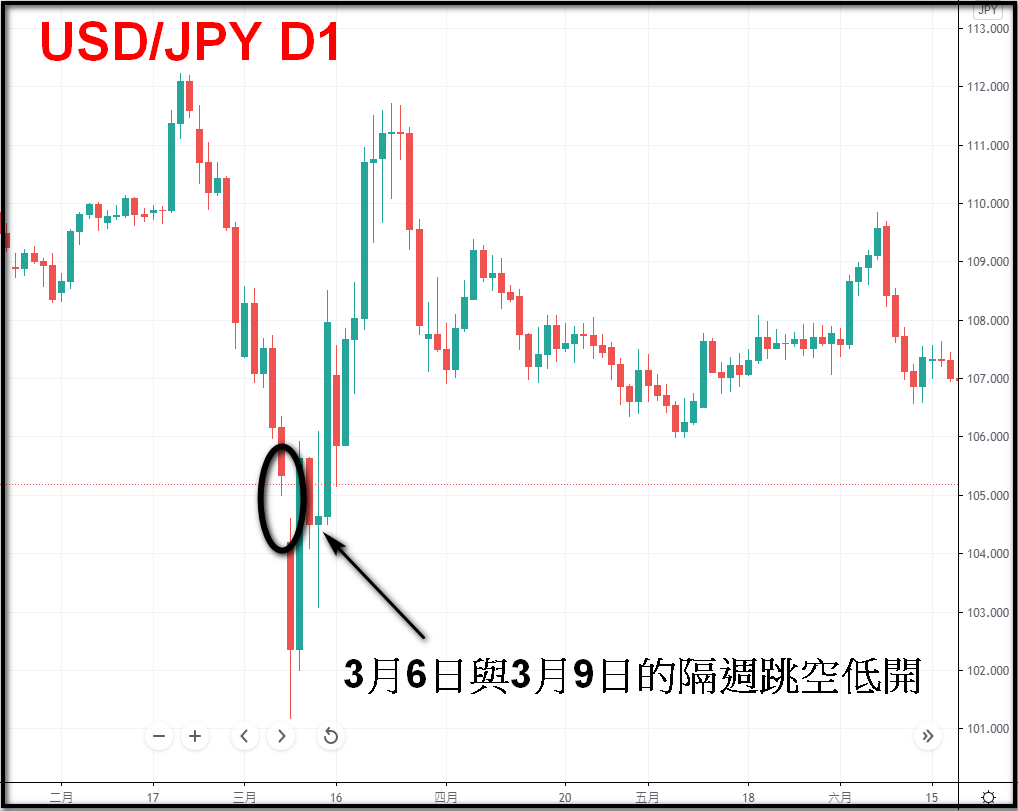

Figure 2: The low opening of USD/JPY on March 6th and 9th every other week

In summary, slippage occurs when the market changes and becomes scattered, resulting in large fluctuations and the inability to find the best match for the trader’s order in the market.

Can slippage be avoided?

You cannot eliminate slippage, but the following points can help you effectively reduce the occurrence of slippage.

1 / Upgrade external hardware

As the saying goes, “if a worker wants to do a good job, he must first sharpen his tools”, the solution is to upgrade your computer’s configuration and network speed. Traders who prepare their external hardware in advance to reduce the possibility of delay on the network or hardware can reduce the problem of slippage caused by delay and avoid unnecessary losses.

2 / Avoid certain market movements

Successful traders must always check the financial calendar every day to avoid the timing of certain high-risk events such as the Federal Reserve’s interest rate decision and the release of U.S. non-farm data. The occurrence of these major events is bound to bring huge fluctuations to the forex market. If you choose to wait and see at this time, it is also a trading strategy to avoid slippage losses caused by insufficient transaction volume.

3 / Try not to hold positions over the weekend

Because the market is closed on Saturday and Sunday, the market price won’t be able to reflect the occurrence of unexpected emergencies during break time. Therefore, at the opening of the market on Monday, the market tends to fluctuate violently, and the probability of slippage arising from the market gap increases greatly. Therefore, at the close of Friday, it is suggested that you close all your positions as far as possible. On the one hand, you won’t be charged an overnight interest fee; on the other hand, you’ll be less likely to suffer loss due to the market gap.

4 / Set transaction mode on the platform

Some trading platforms offer transaction mode Settings that allow the trader to set the maximum spread between the transaction price and the set price, and the system will reject anything outside the margin of error. If the trader does not accept any slippage, you can set the slippage to 0, which means that the price at which the order must be executed at pre-set price. However, this can lead to an unsmooth trading experience overall, as the traders need to re-place orders if not executed and may miss some good trading opportunities

To sum up, for a forex trader, slippage is a normal phenomenon. Despite the uncertainty caused by slippage, there might be a “positive slippage” where the market price moves in a direction that is favorable to the trader and the final executed price becomes better.

——

About ZFX (Zeal Capital Market)

- The Best Trading Platform Award 2019 from Financial Weekly, Regulated by FCA & FSA.

- 100+ trading assets, including Forex, Stocks, Indices, Gold, Crude Oil, etc.

- 3 types of trading accounts to meet the needs of every customer

- 0 commission, low spread, leverage ratio up to 1:2000

- Powerful trading platform that executes 50,000 orders/s

- Open an account with a minimum deposit of $50

- 24-hour Customer Service

——

Risk Warning: The above content is for reference only and does not represent ZFX’s position. ZFX does not assume any form of loss caused by any trading operations conducted by this article. Please be firm in your thinking and do the corresponding risk control.