Natural Gas: Price, Chart, Overview and How to Invest

Natural gas is highly popular as a commodity and a trading asset because it is an energy source with wide usability. Some of the features that attract many investors are the high volatility that offers potential for higher gains and adequate liquidity.

While trading gas in its physical form is costly and complicated, there are more practical and easier ways to profit from it, as this guide will explain. We will also look at the factors that drive the natural gas price up or down, explain how to trade NG and more.

What is Natural Gas? Definition and Overview

Natural gas is widely used for commercial, industrial and residential purposes. It is one of the primary energy sources used for heating, production of electricity and vehicle fuel due to lower emissions. Based on its structure and characteristics, natural gas is considered to be the ‘cleanest’ fossil fuel. It is composed of hydrogen and carbon atoms, and the product of its combustion is water vapour, carbon dioxide and nitrogen oxides.

Natural gas is formed from the layers of plants and animals found in the earth’s crust and under the ocean floor. Millions of years of pressure and intense heat transformed part of the decomposing biomaterial into gas.

Natural gas is composed primarily of methane, but it also has additional components like propane, butane, ethane, and pentanes called Natural Gas Liquids. In its natural form, it is a colourless, odourless and highly flammable gas. Before it is ready for wider usage, raw natural gas is processed and purified into methane. The gas is transformed into a liquid form known as liquefied natural gas for easier transportation.

Natural Gas Price History and Price Today

The commodity trades under the ticker symbol “NG“, and during the last couple of decades, it has been trading from a price of below $2 to more than $15.

Natural Gas Price Historical

NG prices have displayed significant price swings, and it shows a tendency to move by more than 100% in a couple of months. For instance, in less than 7 months in 2005, it climbed by more than 140% when it reached its All Time High price that December. In June 2008, it hit the second-highest price of around $13.7. The lowest price recorded since 2000 occurred in June 2020 when the price plunged to less than $1.5 per million BTU (British Thermal Unit).

Price spikes occur regularly, and natural gas might experience a price spike of tens of percents before the price continues toward its initial direction. The price of natural gas shows the potential to surge or fall by more than 20% within a trading week. It should be noted that gas price is leaned toward the formation of bullish and bearish short-term trends that could last up to a couple of months.

What Influences the Price of Natural Gas?

The commodity’s price is highly sensitive to changes in supply and demand for natural gas. Supply restrictions or a decrease in production may cause a surge in gas prices when there are no changes in the demand. Supply factors that could cause changes in its price are:

- Changes in the production quantities

- Amount of gas in storage facilities

- The level of gas import and exports

- Severe weather conditions – adverse weather conditions could interrupt the regular supply of natural gas.

An increase in demand for natural gas will cause a surge in its price when the supply levels remain the same. Some of the factors that could lead to changes in demand for natural gas are:

- Weather conditions –the demand for gas increases in cold months, whereas hot summers might cause a rise in natural gas prices through increased demand for electricity.

- Changes in economic activities – during an economic expansion, a rise in production levels will cause an increase in demand for natural gas.

- Prices of competition – lower prices of alternative fuels and energy could have a negative effect on the demand for gas.

- Changes in crude oil prices.

Natural Gas Price Today Chart

Overall movement in the price of natural gas since 2000 is displayed in the following chart.

The natural gas price chart shows that the price of this commodity cannot sustain a well-defined long-term trend. Instead, its price moves in a cyclical manner where it repeatedly shows upward movements followed by a peak and a downtrend. The size and length of each price cycle vary, and the difference in the bottom-peak-bottom price cycle may reach well over 100 %, while a smaller range is more common.

Moreover, it is evident from the natural gas chart that price spikes also appear regularly, but in the past, the size of these spikes was larger.

Why Invest in NG Today?

Here are some points which make natural gas an investment you should consider:

- Energy sector attractiveness – the characteristics and usability of gas makes it alluring for investors and traders.

- Liquidity – the popularity of the oil and gas sector and the versatile application of the commodities mean that there is a sufficient level of liquidity in the energy market.

- Dependence on natural gas – electricity production is highly dependent on natural gas due to the utilization of gas-fired power plants.

- Volatility – natural gas prices tend to be more volatile compared to some of the other commodities. A higher volatility means that changes in the gas process might bring in higher returns.

- The International Energy Agency expects the demand for gas to rise by nearly 30% by 2040. Hence, a stable upward movement in demand for gas could also lead to appreciation if there are no major changes in supply levels.

- As as a clean fossil fuel, gas represents a vital alternative to eco-friendly energy.

- Anticipation of price rise – experts and analysts anticipate that the natural gas price will rise in the future as a result of demand-led factors.

Natural Gas Futures and Natural Gas CFD : What’s the Difference?

Although Natural Gas Features and Natural Gas CFDs are both derivative financial instruments associated with gas, there are significant differences.

Natural Gas Future

Natural Gas Futures represent a contract that creates an obligation to purchase the stated quantity of gas at a pre-defined date and price. The futures price is expressed per million British thermal units (BTUs). Futures are available for trading on the Intercontinental Exchange (ICE) or Multi Commodity Exchange (MCX). The futures are considered a complex trading instrument because of the tight enforcement rules, expiration dates and the settlement method. Moreover, NG Futures might be adequate and cost-effective for high volume traders because of the contract sizes.

Natural Gas CFDs

Traders use CFDs to speculate on the movements in natural gas price because this instrument offers higher flexibility and doesn’t impose an obligation to the trader. The traders can easily buy or sell CFDs and profit from movements in the price of gas. In general, trading CFDs is less costly than trading futures because brokers charge lower fees and commissions. Also, unlike futures, Natural Gas CFDs require lower margins and opening an account with a CFDs broker is possible with a lower level of capital, and it is not as complex as opening an account for trading futures.

Where Can I Trade NG?

Investors and traders can trade natural gas via online brokers, like ZFX. ZFX offers CFDs that are linked to NG and with many advantages for traders. Traders can thus benefit from features that are not readily available with direct purchase of this gas or when trading Natural Gas Future. ZFX also offers these additional advantages:

- High regulation

- Competitive fees

- A wide range of trading assets

- High leverage

- Low initial capital

- Easy to understand trading platform for inexperienced and experienced traders

- Demo trading account

- Learning resources

How to Start Investing in Natural Gas Now

Knowing the characteristics of natural gas as a potential investment asset raises the question of “How to trade natural gas” today. The positive aspects of CFDs place them among the best available options, and the process to traded NG CFDs on ZFX comprises of a few simple steps,. Go through the details of each step to see how you can trade gas.

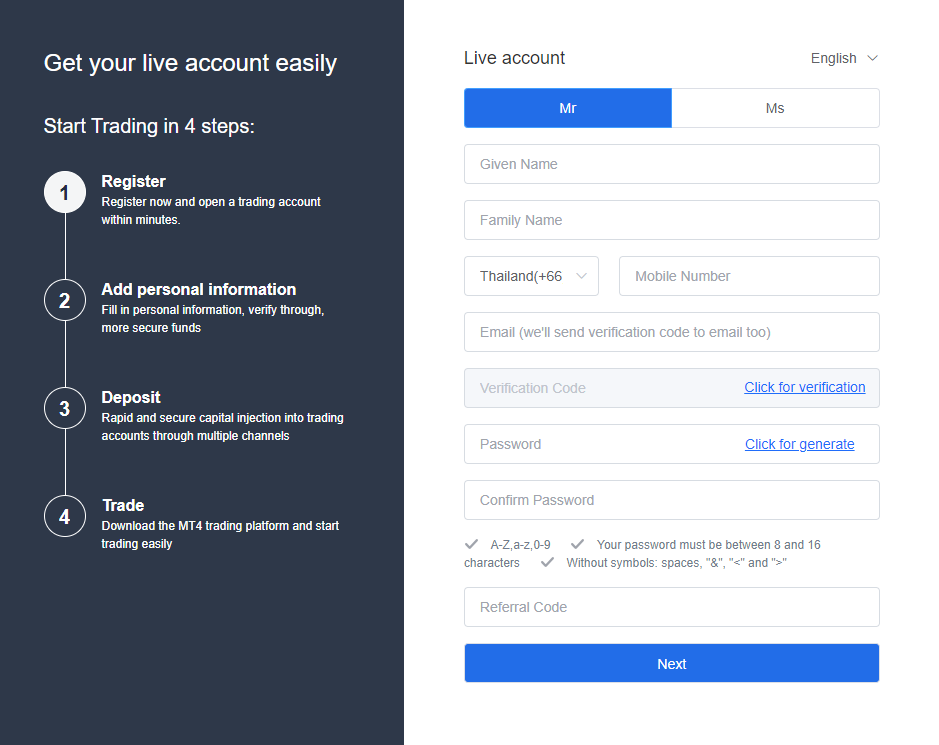

1. Register with ZFX

To buy and sell Natural Gas CFDs, you need to create a ZFX account. To do so, go to ZFX’s website and select the relevant button. Look at the following image.

As you can see, ZFX gives you an option to open a demo account, a valuable practising method before you invest real capital. Selecting the preferred option will take you to the following window.

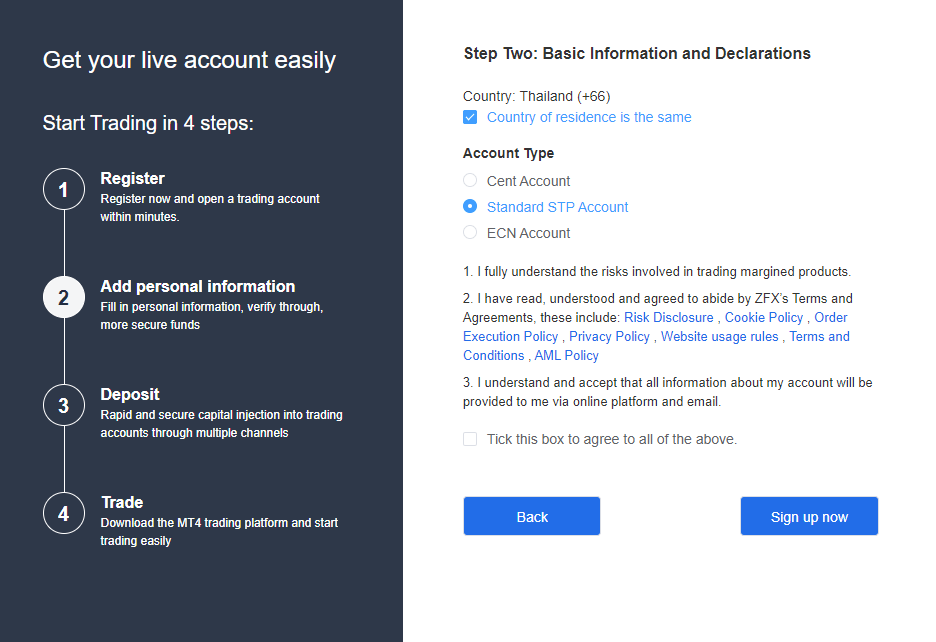

To finish the registration, just fill in the required information. After you register an account, you need to verify your identity.

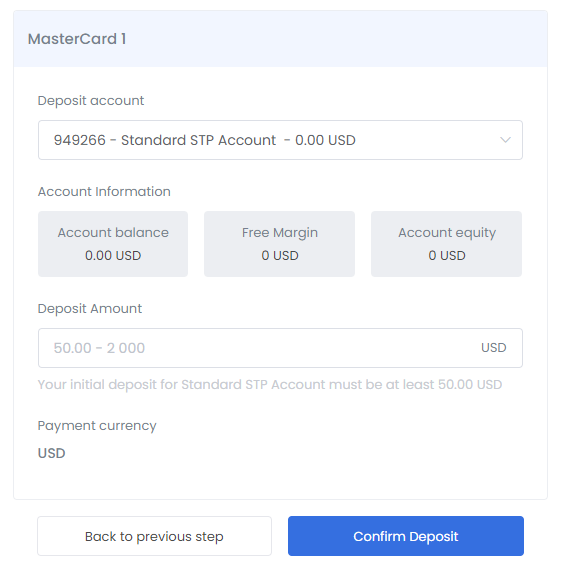

2. Make your first deposit

You can fund your account by logging into your account and going to the “Deposit” section. ZFX offers multiple funding methods, so you can fund your account via Bank Transfer or Credit Card. ZFX will not charge deposit or withdrawal fees.

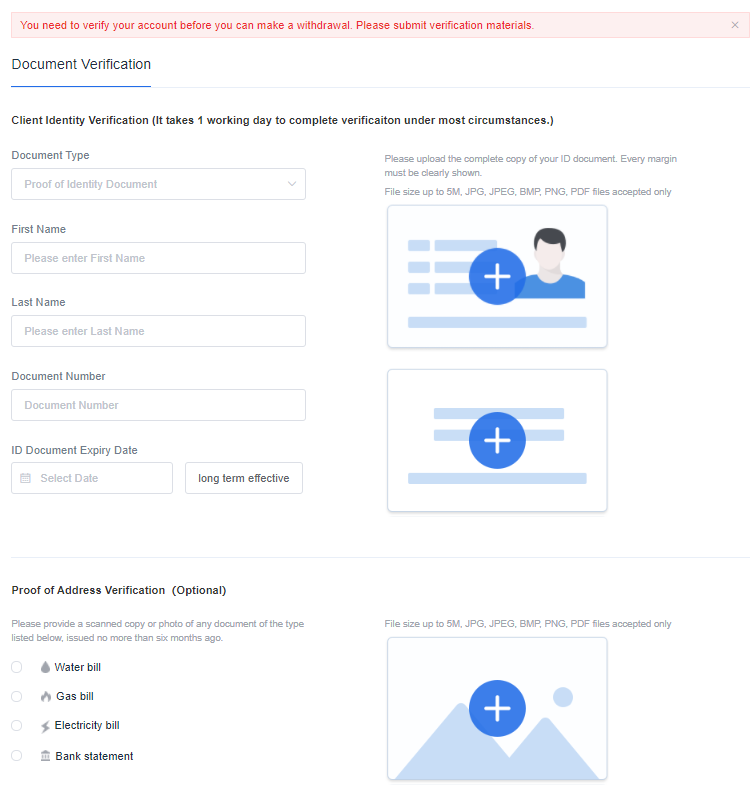

3. Account verification

ZFX offers a simple and quick verification process. You need to have a valid document – national ID, passport or driver’s license. During the verification process, you will need to upload specific pages from your document. You also need to verify your bank account, by uploading your bank statement or the requested page from your bank book.

4. Trade NG

The final step to trading gas is to download the applicable ZFX MT4 platform, which is available on the ZFX website.

After installing MT4, you open it and log in to your account with credentials sent to your email. When you’re logged in, select natural gas (NG) from the “Market Watch” bar on the left side. The graph that emerges shows Natural gas real time price, and this is where you execute your trading orders. The natural gas quote is also available on the ZFX website.

Tips and Things to Know Before Trading Gas

Given the popularity of NG as an asset, here are some factors to consider before trading:

- Trading sessions for natural gas are Sunday to Friday New York time. Trading is interrupted then for just one hour on those day, from 5pm to 6pm EST.

- Stay updated and follow the natural gas news related to factors with significant implications for movements in gas prices – electricity productions, economic growth…

- Monitor major producers of gas.

- NG trading can actually be based on a variety of strategies due to how its price fluctuates. Swing trading, day trading strategy, trend or range trading strategy, buying dips, breakout strategy… Make your choice based on your objectives and preferences.

- Remember that although you could make higher returns thanks to gas’ high volatility, this also means that there might be a higher risk of capital loss.

Natural Gas Forecast, Future and Prediction

Analysts and experts attempt to forecast future price movements based on changes in the demand and supply for gas and through technical indicators. Considering the results obtained through different analyses, natural gas forecast enjoys a bullish expectation about its future price movements.

- Fitch Ratings have raised their assumptions for short term movements in natural gas price due to promising changes in the demand and supply,

- CNBC also points toward a possible price growth in the upcoming period. This is because they expect an increase in demand, but not a respective rise in supply.

- Experts anticipates that gas prices may go well beyond $8 per million BTU in the intermediate run. Other natural gas price forecasts point toward the possibility for the natural gas price to double in the near future.

Natural gas forecast based on technical indicators and technical analysis identify possible upward movement in the price. When plotted on daily, weekly, and monthly time frames, multiple Simple and Exponential Moving Averages are in consensus and assign a “strong-buy” rating. Other popular indicators detect bullish signals when used in the technical analysis of past movements in the price of natural gas.

Bottom Line: Is Natural Gas a Good Investment Now?

Natural gas is highly alluring for investors due to its volatility level that offers opportunities for above-average returns to be made. While many factors could affect the natural gas value, analyses show this commodity is a good investment. Indeed, when we consider supply-led and demand-led factors, analysts expect to see an increase in price in the near future.

If you wish to start trading gas today, then you can open a ZFX account now. It only takes a few simple steps. You’ll then be able to invest in the commodity and many other promising assets. Trade today on a highly regulated and efficient platform.