While the index touched 6,000 points within the first seven years, it wiped off the majority of these gains to trade near 3,145 in March 2009. It regained the 6,000-point level in December 2017 and touched 7,000 for the first time ever in early 2020. During the bear market of March 2020, the S&P ASX 200 Index plummeted to 4,800 points before a snap-back rally pushed the index to its current price of 7,256.

We can see that in the last 21 years, the index has returned over 4.2% annually. In the same period, the S&P 500 index has generated annual returns of more than 5%. After adjusting for dividends, annual returns are closer to 8.63% for the S&P ASX 200 Index.

However, similar to most other global indices, the S&P ASX 200 has delivered solid returns post the financial crisis of 2008-09. In the last 10 years, its annual returns stand at 10.8%. In the last five years, returns are marginally lower at 10.4%. And finally in the last 12-months, it has gained by a stellar 30.56% and is up over 14% year to date.

What Influences the Price of the S&P ASX 200 Index?

S&P/ASX 200 is influenced by a variety of macroeconomic factors. As it consists of the 200 largest companies in Australia, a market crash or recessionary patterns can be noticed in price trends. Let’s look at a few major factors that impact the performance of the index.

-

S&P ASX 200 and the Australian GDP

Domestic and international parameters affect the S&P/ASX 200 performance. For example, the economic recovery experienced in 2021 has been reflected in stellar gains since October 2020.

Australia’s GDP is now forecast to grow by 5.1% year over year in 2021 and be close to pre-pandemic levels by the end of 2022, according to estimates by the OECD. These trends have been the primary driver of the index’s bullish run in the last 12-months which has been supported by relaxation of lockdown rules and increased consumer spending as well as a low-interest rate environment.

-

S&P ASX 200 and the World Economy

In today’s world, no economy is immune to a global crisis. The dot com bubble hit the S&P ASX 200 Index hard, as did the 2008 financial crisis. More recently, the debt crisis around China’s real estate giant Evergrande has resulted in near-term volatility in financial markets worldwide.

Further, international capital inflows, as well as foreign portfolio investments, come via the stock market. So, if an institutional investor from the U.S. invests in Australian equities, any global or domestic crisis will trigger a sell-off if the investments are withdrawn.

Another key metric that impacts the S and P ASX 200 index is the performance of the Australian Dollar. According to data from World Bank, Australia’s exports of goods and services account for 24% of the GDP while imports account for 21.6% of GDP.

So, if the Australian dollar depreciates with respect to the USD, exports might experience an uptick, but the country’s citizens might have to shell out more to import products. Alternatively, if AUD gains momentum, it will also attract foreign institutional investors, looking to generate higher returns over time.

-

The Central Bank and Interest Rates

This is one of the most important factors that impacts any stock market. The policies of a country’s central bank are closely tied to stock market performance. A dovish monetary policy that includes lower interest rates and an increase in money supply will lead to an inflow of stock market investments. But, in the current scenario where there is a possibility for rising inflation rates, central banks might raise borrowing rates and tighten the money supply which will shift investment capital towards low-risk assets such as bonds and cause a sell-off.

The ongoing pandemic and shutdown of global borders drove economies into recessions. This was offset by federal benefits offered to businesses and individuals impacted by COVID-19, at least in the developed world.

The rising unemployment rates triggered a sell-off in banking stocks as the risk of defaults increased substantially. Further, energy stocks too fell off a cliff due to the falling demand for oil. Retail, travel, and tourism were also affected. As a result, ASX 200 slumped by 35% between February and March 2020.

Despite Australia’s vaccinations rollout, the threat of the delta variant as well as the possibility of virus mutations in the future will continue to weigh heavily on the ASX S&P 200 Index.

S&P ASX 200 Companies and Constituents

The S&P ASX 200 Index constituents consist of the 200 largest publicly-traded companies in Australia. But who are they and how are they chosen?

S&P ASX Stocks Requirements

S&P ASX stocks require minimum relative liquidity of 50% to be included in the index. So, if a stock’s relative liquidity falls below half of the 50% threshold it becomes ineligible and is removed from the next balancing review.

As the index is float-adjusted, the numerical contribution to the index is relative to a stock’s value at the float of the stock. So, the calculation begins by taking the sum of the market cap of stocks part of the index and is intended to account for changes in share prices.

SP ASX 200 Companies Breakdown

S&P ASX 200 constituents can be categorized in 11 sectors. The sector breakdown is as below:

-

Financials: 31.1%

-

Materials: 7.2%

-

Healthcare: 10.3%

-

Consumer Discretionary: 8.3%

-

Industrials: 7.2%

-

Real Estate: 7%

-

Consumer Staples: 5.3%

-

Information Technology: 4.5%

-

Communication Services: 4.3%

-

Energy: 3.2%

-

Utilities: 1.5%

The largest company on the index is the Commonwealth Bank of Australia that has a market cap of $176 billion. Other large-cap stocks include CSL Ltd, BHP Group, Westpac Banking, and National Australia Bank.

S&P ASX 200 List of Stocks

The top 20 stocks of the S&P/ASX 200 Index are as follows.

|

Company Name

|

Ticker

|

Sector

|

|

Commonwealth Bank of Australia

|

CBA

|

Financials

|

|

CSL Ltd

|

CSL

|

Healthcare

|

|

BHP Group Ltd

|

BHP

|

Materials

|

|

Westpac Banking Corporation

|

WBC

|

Financials

|

|

National Australia Bank Ltd

|

NAB

|

Financials

|

|

Australia and New Zealand Banking Group Ltd

|

ANZ

|

Financials

|

|

Macquarie Group Ltd

|

MQG

|

Financials

|

|

Wesfarmers Ltd

|

WES

|

Consumer Discretionary

|

|

Woolworths Group Ltd

|

WOW

|

Consumer Staples

|

|

Telstra Corporation Ltd

|

TLS

|

Communication Services

|

|

Fortescue Metals Group Ltd

|

FMG

|

Mining

|

|

Transurban Group

|

TCL

|

Infrastructure

|

|

Goodman Group

|

GMG

|

Real Estate

|

|

RIO Tinto Ltd

|

RIO

|

Mining

|

|

Afterpay Ltd

|

APT

|

Financials

|

|

Aristocrat Leisure Ltd

|

ALL

|

Consumer Discretionary

|

|

Woodside Petroleum Ltd

|

WPL

|

Energy

|

|

Coles Group Ltd

|

COL

|

Consumer Staples

|

|

Sydney Airport

|

SYD

|

Infrastructure

|

|

James Hardie Industries Plc

|

JHX

|

Materials

|

Should I Trade the S&P ASX 200 Index? Points to Consider

Here are a few things that traders need to consider before they invest in the S&P ASX 200.

- An Index with Potential Consistent Returns

Investors who invest in the S&P ASX 200 Index gain exposure to some of the largest companies in Australia. Investing in blue-chip companies with strong economic, strong balance sheets and stable cash flows can allow you to generate inflation-beating returns consistently. We have seen since its inception, we can consider this popular index as a proxy to the Australian economy has returned around over 8% each year which means it has increased purchasing power for investors over time.

You might not be able to derive double-digit gains each year, but the aim of a large-cap portfolio is to generate steady gains. Further, these companies have survived economic recessions in the past showcasing their resilient business model.

- An Interesting Dividend Yield

The S&P ASX 200 index also provides investors with a tasty dividend yield of 3.33% which is much higher compared to current interest rates in the country. So, if you invest $10,000 in this index today, you can generate $333 in annual dividend payments that can either be reinvested or withdrawn.

How Can I Trade the S&P ASX 200 Index?

Investors interested in the Australian economy can invest in the S&P/ASX 200 Index by identifying ETFs that track the index. Alternatively, you can also get exposure to the index by instruments such as contracts for differences (CFD). The comparatively lower brokerage and commission charges associated with CFD trades allow investors to generate higher returns.

ZFX is a the leading CFD trading broker. It is a highly regulated broker, which offers competitive fees and the popular MT4 platform, as well as a wide range of trading assets. You can trade many indexes as well as stocks, commodities and currencies through the platform. Here’s how you can trade AUS200 via ZFX.

-

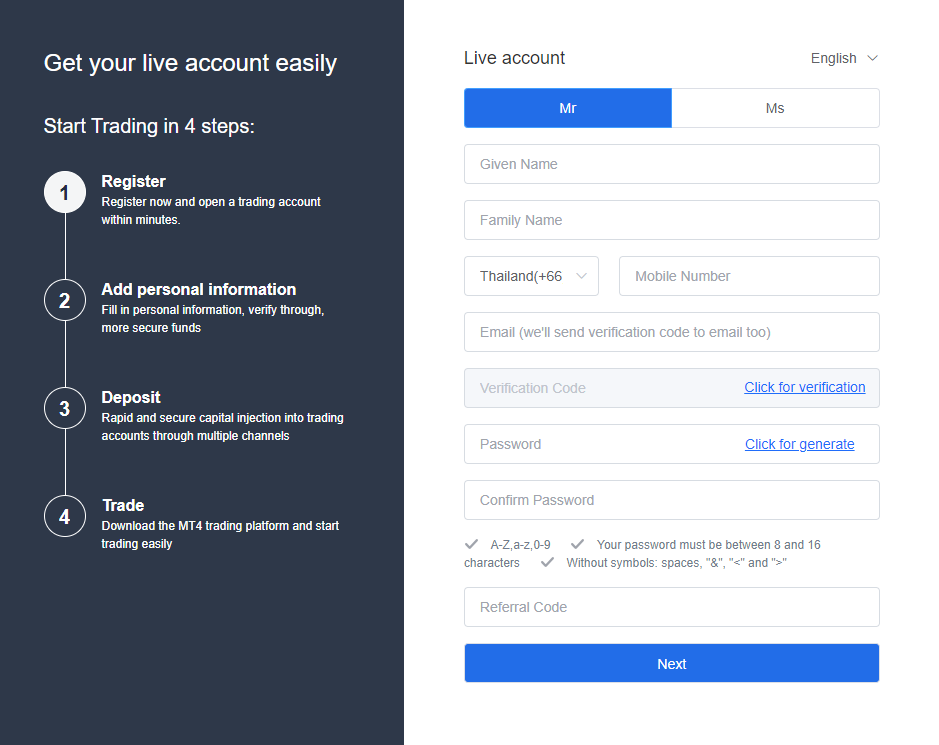

Open an account with ZFX

You can open you ZFX online within minutes. Simply go to the ZFX website, and select “Open an Account” at the top of the homepage. A registration form will appear, which you just need to fill in. Then, press “Next”.

-

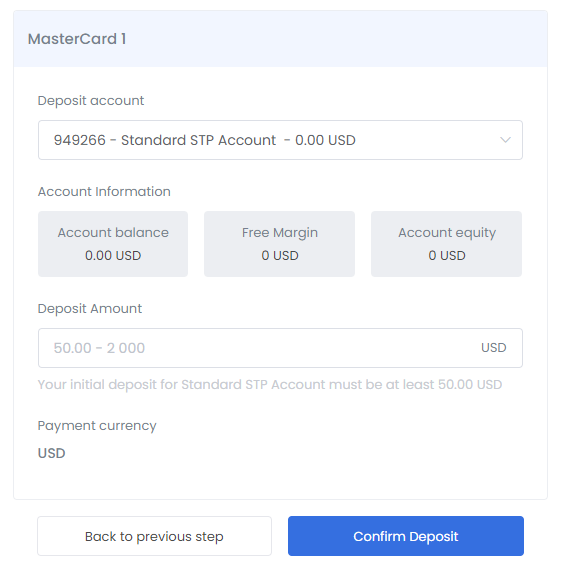

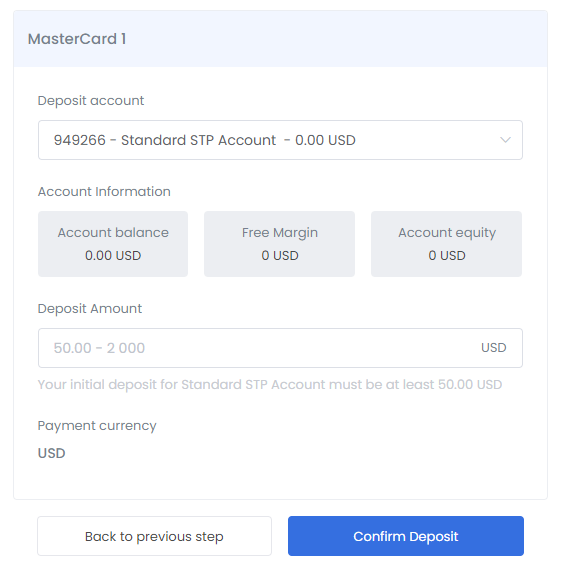

Fund your account

Depositing funds into your account is the next step. To do so, select the “Make a deposit” option which is displayed immediately after registration. Depending upon the type of account you choose, you can commence your trading journey with $50 to $1000. Choose your amount and payment method, then, click on “Confirm Deposit”.

-

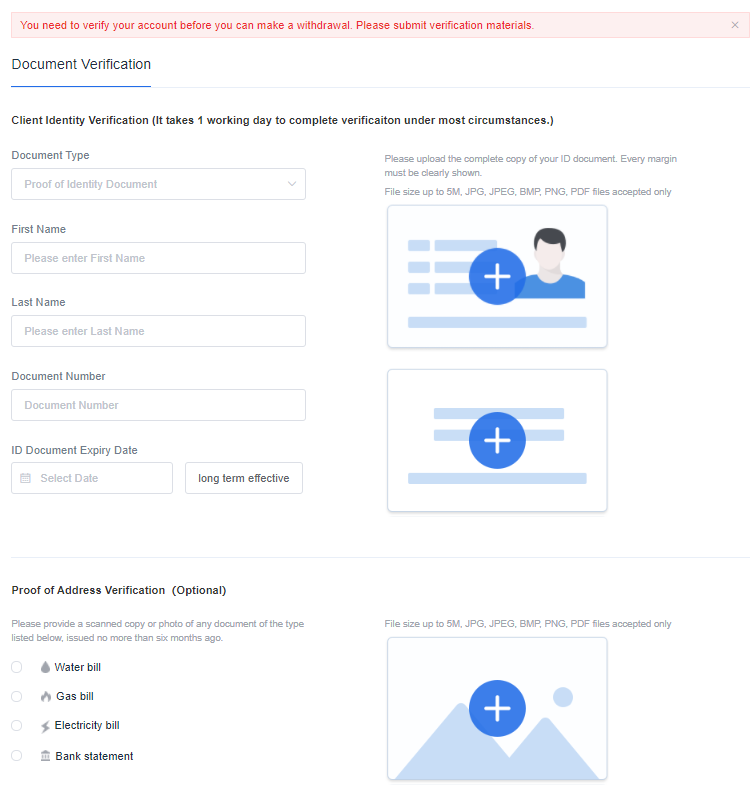

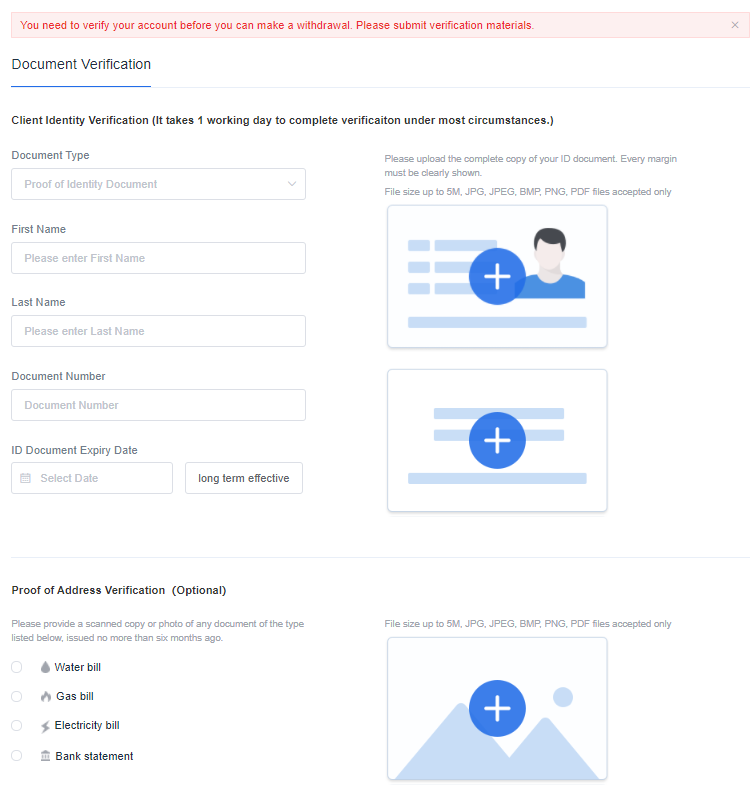

Verify your account

The personal identification documents and bank information are verified by ZFX in this step. Simply upload a scan of the required documents on the platform. Following successful verification, your trading account will be active.

-

Start trading on the AUS200

The Australian benchmark index CFD is available on the ZFX Platform under “Australia S&P ASX 200 Index AUS200.” Investors can invest directly in this index through ZFX, which uses the MT4 platform for placing and processing investment orders.

Things to Know Before Investing in the S&P ASX 200 Index

Here are a few tips that will help you trade AUD200 in the best conditions.

-

Investors cannot directly invest in the S&P ASX 200 Index. However, you can do so via ETFs or CFDs, which ZFX offers.

-

S&P ASX 200 it an AUD denominated index. This means foreign currencies are converted to Australian dollars at the prevailing exchange rate before investments are processed.

-

The Australian markets are open on ASX business days between 10am to 4pm Sydney time, also called Australian Eastern Daylight Time. These are called normal trading hours, and are when most of the trades take place. Keep this in mind and make sure you convert these hours into your local timezone.

-

The pre-opening phase takes place between 7am and 10am while overnight trading is between 4:12pm and 6:50pm between Monday to Friday.

-

Extended trading hours are sessions before and after the market close. Here, you can trade electronically. These trading sessions generally have lower trading volumes compared to regular hours.

S&P ASX 200 Index Future, Forecast and Predictions

The recent S&P ASX index uptick was a result of strong performance by U.S. indices, after the Senate approved a bill which means the government is on track to pay upcoming interest and debt payments.

According to a report from Trading Economics, the S&P ASX 200 index is expected to trade at 7040.35 points by the end of 2021 and might fall to 6,622.16 in 2022. These estimates are based on analysts’ forecasts and global macro models.

Bottom Line: Is the S&P ASX 200 Index a Good Investment Now?

The S&P ASX 200 is a benchmark for the Australian economy and is tracked widely by several market participants that include institutional investors, money managers, and retail investors all around the world. The long-term prospects of the economy remain robust and the index should continue to deliver inflation-beating returns in the upcoming decade.

But, investors should note that the underlying market volatility might turn markets bearish and we can expect a pullback in the near future. While it’s impossible to time the market, we can view every major market correction as a buying opportunity for investors.

If you’re ready to invest in AUD200, you can do so today through ZFX. This broker offers high regulation and provides all the resources and features needed to trade this index and many more assets in a very simple way.