NZDJPY: New Zealand Dollar-Yen Rate, Chart and Forecast

The foreign exchange (forex) market is the largest financial market in the world, with an average daily transaction volume of more than $5.3 trillion. Among the many currency pairs available is NZDJPY. This currency pair involves the New Zealand dollar and the Japanese yen. It is ideal for investors aiming to maximize their profit margins by undertaking currency carry trades. Though the risk associated with NZD JPY is relatively high, investors are compensated for it with higher returns.

What is NZDJPY? Overview

The NZDJPY pair represents the correlation between New Zealand Dollar and the Japanese Yen.

- NZD is the legal tender of New Zealand and several neighboring islands such as the Cook Islands, the Ross Dependency, Niue, and the Pitcairn Islands. It is issued and circulated by the Reserve Bank of New Zealand.

- JPY, on the other hand, is the national currency of Japan. It is the third most traded currency globally after US Dollar and Euro and is often considered a reserve currency. Japanese Yen accounts for 16.8% of total forex transactions. Contrarily, NZD is the tenth most traded currency globally.

For example, if the value of NZDJPY live is 77.094, then this means that 1 New Zealand Dollar is worth 77.094 Japanese Yen.

NZDJPY Chart

Technical analysts and retail traders use NZDJPY live chart to identify the breakout points, signaling the ideal entry and exit points.

How to Read the NZDJPY Chart

Traders can discern the NZDPY correlation by analysing the chart mentioned above. The currency pair has gained 3.63% over 2021 and 2.86% year-to-date, indicating that the NZD has modestly appreciated against JPY. As many consider JPY a safe haven reserve currency worldwide, it has underperformed against the NZD during the robust global economic recovery. Indeed, investors have started taking on higher risk.

NZDJPY Historical Data

Between 2006 and 2021, NZ Dollar to Yen currency pair has gained more than 17%. This thus demonstrates the strength of the New Zealand Dollar. However, during times of economic crisis and/or market volatility, NZD/JPY has declined sharply. During the 2008 financial crisis triggered by the subprime crisis in the United States, the NZD to JPY fell to a historic low of 45.284. However, it demonstrated resilience during the first wave of the Covid-19 pandemic in March 2020. Indeed, NZD to Yen pair hit its multi-year low of 59.561.

NZD/JPY currency pair has been popular among carry traders, given the interest rate differences between the two countries. While Japan has a negative benchmark interest rate of 0.1%, NZ’s interest rate was recently hiked to 0.75%. Traders often take a long position in the NZD JPY currency derivate, selling JPY while simultaneously buying NZD to capitalize on the difference in the interest rates in both countries.

NZ Dollar to Japanese Yen carry trade is easy to understand. For simplification, assume that the benchmark interest rate in Japan is 2%, while the interest rate in New Zealand is currently 10%. Carry traders aiming to profit from this arbitrage opportunity typically sells (shorts) Japanese currency on leverage (using borrowed funds) and invest the proceeds in New Zealand Dollar. As a result, traders generate 8% returns (2% interest is paid to JPY, while 10% is earned from NZD). Leverage trading also increases the returns generated, depending on the terms and conditions set by the broker and margin requirements.

NZDJPY Exchange Rate History

NZDJPY correlation has historically been more than 1, indicating that NZD is stronger than JPY. Though NZD has strengthened 17% against the JPY since 2006, JPY is still considered a reserve currency and the third most traded globally.

The NZD/JPY derivative value ranges from a low of 45.284 to a high of 97.76. The currency pair hit its all-time high of 96.76 in August 2007, when the global economy was peaking due to the housing market boom in the United States. NZD typically outperforms JPY during times of economic boom, as New Zealand witnesses substantial export demand, increasing the demand for its currency. On the other hand, the Japanese Yen is considered a safe-haven currency, gaining traction during market volatility.

As an example, between September and December 2021, NZD/JPY has declined 1.53%, reflecting the growing concerns regarding supply chain disruptions, inflationary pressures, and the resurgence of Covid-19.

NZDJPY Exchange Rate Today

The NZDJPY currency pair fluctuates on a daily basis. In December 2021 for example, it stood at around 77.094. The bid price of the currency pair was 77.034, while the ask price was 77.154. As one of the most frequently traded currency pairs in the world, NZ Dollars to Yen has a relatively low bid-ask spread. The forex markets are open 24 hours a day, so the NZD/JPY keeps fluctuating.

What Influences NZDJPY Exchange Rate?

1. Market Stability

While NZD and JPY fall under the top 10 most traded currency pairs globally, the currency pair accounts for less than 2% of the forex transactions. It is traded less frequently compared to popular currency derivatives such as EUR/USD, USD/JPY, and USD/CHF. Thus, market stability plays a major role in the NZD JPY forecast.

During periods of economic growth and bullish market trends, NZD is expected to appreciate against JPY, causing NZD/JPY to gain substantially. However, as the Japanese Yen is viewed as a renowned safe-haven currency, it has strongly appreciated during market volatility and economic slowdown. As a result, NZD to JPY currency pair tends to decline during such periods.

2. China and NZD/JPY

NZD is often viewed as a proxy for Chinese economic growth., as China is New Zealand’s biggest trading partner. Thus, robust growth of the world’s second-largest economy drives up the demand for New Zealand’s exports, causing NZD to appreciate.

Japan also maintains strong “mutually beneficial” trade relations with China. However, the Japanese government recently spoke out against China’s military operations in the Taiwanese strait, which has put a strain on their relationship. Since then, Japan has been issuing statements to preserve its trade relations with China. Japanese foreign minister Motegi Toshimitsu recently said, “Japan attaches great importance to its relations with China and remains committed to ensuring the steady development of Japan-China relations.”

3. Monetary Policies and Open Market Operations

Reserve Bank of New Zealand hiked its official cash rate (benchmark interest rate) by 25 basis points on November 24, 2021, to 0.75%, amid continued inflationary pressures. It is one of the first central banks globally to adopt a hawkish monetary policy.

On the other hand, Bank of Japan (BOJ) has kept its short interest rate at negative 0.1%. The central bank is expected to maintain this dovish stance at least over the next two years to fuel Japan’s economic growth. Its 10-year government bond currently yields 0%. Moreover, Japan is one of the few countries not facing tremendous inflationary pressures, as the higher prices are absorbed at the production level. Though the wholesale inflation level in Japan hit its 13-year high in September, relatively low consumer demand has kept the consumer price indexes relatively unaffected. In fact, the BOJ reduced its consumer inflation forecast from 0.6% to 0% for the fiscal ending March 2022.

Despite the negative interest rates, BOJ forecasts export demand to increase with global economic recovery, strengthening JPY.

4. Commodity Prices

Major New Zealand exports include raw materials and agricultural produce. The country’s largest trading partner is China. Indeed, the total two-way trading transaction amounting to more than NZ$33 billion. New Zealand also has solid trade relations with developed economies such as the United States, Australia, Japan, and South Korea. As the manufacturing and industrial activities resume following the Covid-19 precipitated lockdowns, the demand for raw materials has been rising rapidly since late last year. Thus, New Zealand’s exports have become more valuable, strengthening the NZ Dollar.

However, due to sluggish consumer demand in Japan, wholesalers suffered from the rising commodity prices. However, with lower global demand for Japan’s finished products and specialized services, JPY has remained relatively weak with respect to NZD.

5. Carry Trade Opportunities

The difference in benchmark interest rates in Japan and New Zealand makes NZD JPY ideal for currency carry traders. With New Zealand recently hiking its interest rates while Japan is maintaining a dovish stance, currency carry traders could generate substantial profits by trading this currency pair.

While New Zealand is one of the first countries to hike its interest rates, analysts expect Japan to hold its short-term interest rate at the current levels and below its 2% target until at least 2023. Thus, NZD to Japanese Yen is expected to gain traction amid carry traders.

NZDJPY Forecast and Predictions

Though New Zealand dollar to JPY has been slumping lately. This is because of macroeconomic weakness and hawkish pressures from the Reserve Bank of New Zealand. However, as countries adjust to the mutating forms of the virus and the supply chain bottlenecks resolve, NZD is expected to appreciate in terms of the Japanese Yen. Moreover, DBS Research experts predict that the Bank of Japan might keep its interest rates at the current levels despite the inflationary pressures to accelerate GDP growth at the expense of a weaker JPY.

Also, NZD is heavily correlated with the Chinese Yuan, as China is the largest exporting partner of New Zealand. Strong trade relations between the two countries are expected to boost NZD’s value in the near term. China has been the fastest recovering economy from the pandemic-fueled recession, causing NZD to rebound quickly. Thus, the NZD JPY forecast seems bullish.

Why Trade NZDJPY Today?

The Pair Offers Arbitrage Opportunities

The currency carry trade opportunities are an integral part of NZDJPY analysis. Returns generated from NZD JPY carry trades are substantially higher than the returns from traditional currency pairs such as USD/EUR, AUS/CHF, EUR/JPY, etc. Moreover, most currency brokers allow traders to buy or sell derivatives on margin, provided traders maintain a minimum balance in their account. As leverage increases the earnings from such trades, investing in NZDJPY on leverage can allow retail traders to generate substantial capital gains.

A Relatively Low Risk Asset

Though NZD JPY accounts for a small percentage of global forex transactions, the currencies fall in the top 10 most traded currencies list individually. Moreover, both Japan and New Zealand are stable and developed economies. Thus, this makes NZD and JPY relatively less risky. Though the currency pair might fluctuate in volatile markets, analysts expect it to stabilize over the long term. Moreover, as market trends reverse frequently, the loss margin becomes more limited.

It Shows Resilience in Volatile Markets

While NZD tends to appreciate during economic boom, many consider JPY as a reserve currency, limiting losses during market turmoil. Thus, the currency pair’s daily range is relatively small. The difference between the daily high and the daily low today is 1.3, despite the surging volatility due to the rapid spread of the Omicron Covid-19 variant.

Where Can I Invest in the NZDJPY Pair?

Choosing a trustworthy broker, compliant with myriad international rules and regulations is essential while trading NZD JPY. ZFX is one of them and offers many benefits to its clients. These include a wide variety of assets, strong regulation, a free demo account, educational resources and more.

How to Trade NZDJPY Now?

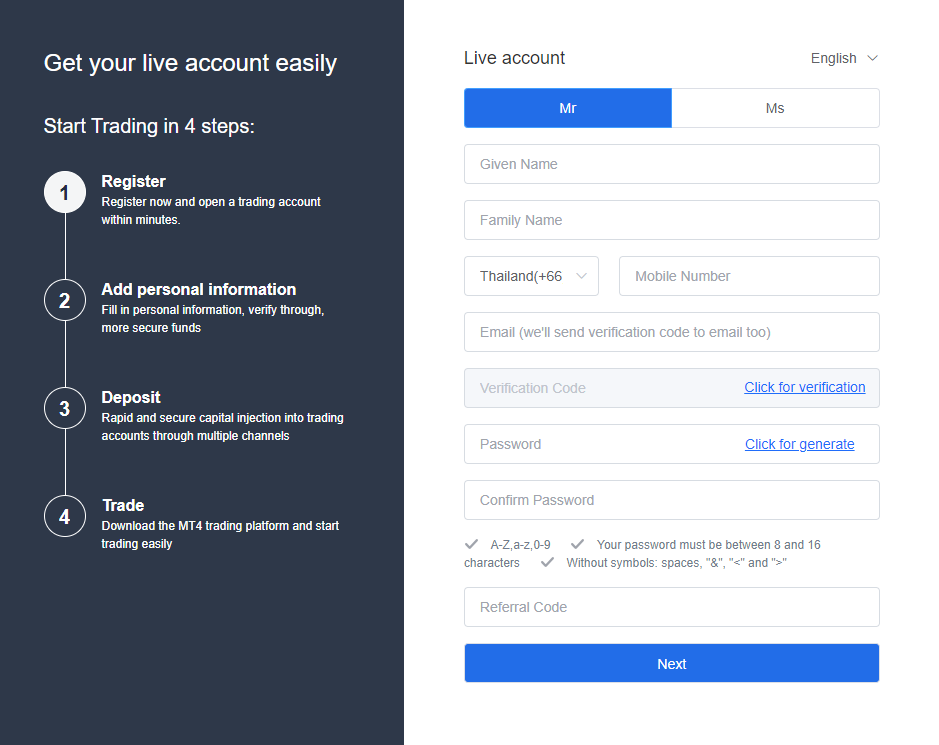

Step 1: Open a ZFX Account

Enter your full name, mobile number, and email to register on the ZFX Platform. You can also opt for a demo account on the ZF platform to get hands-on experience in forex trading.

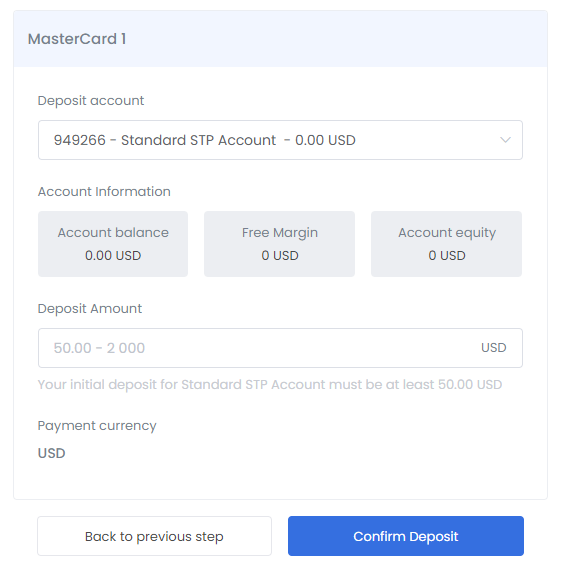

Step 2: Make your First Deposit

You can now deposit funds into your account. To do so, go to the “Make a deposit” section. Then, enter your details and invest the amount you want. Note that you can deposit funds using a credit card or a bank transfer.

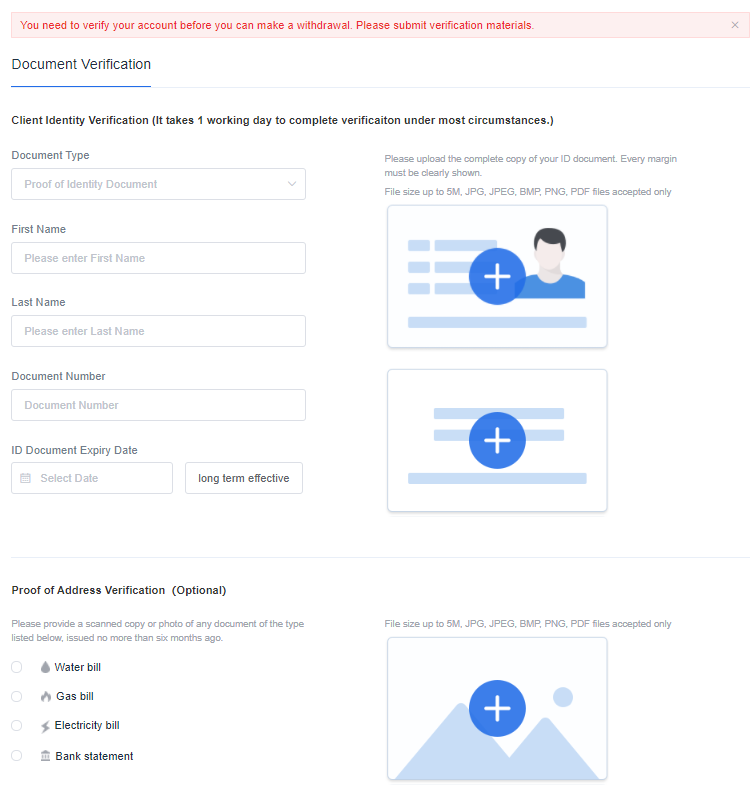

Step 3: Verify your Account

Once you have done this, your account needs to be verified. Submit scanned copies of personal identification proof on the ZFX platform. This can be a national ID card, driver’s license, or passport. You have to upload a photo of your bank book or a copy of your bank statement as well to verify your account.

Step 4: Start Trading NZDJPY

Download MT4 from ZFX to begin trading. With powerful analysis tools, an assortment of instrument options, and fully scalable programs… MT4 is one of the most popular Forex trading platforms in the world.

Tips for NZDJPY Beginner Traders

Look for Currency Pairs with Low Transaction Costs: Beginner forex traders should aim for currency pairs with low bid-ask spread, to minimize the trading costs. NZDJPY has a 0.06 bid-ask spread, making it one of the most liquid currency pairs in the capital markets.

Keep a Short-term Investment Horizon: Forex traders generally have a short investment horizon, as the currency markets are highly receptive to market changes. Moreover, as the forex markets are open 24 hours a day, five days a week, the markets are extremely liquid. Thus, beginner traders can assume slightly high risk by investing in currency pairs such as NZDJPY. However, the short-term investment time frame and highly liquid markets can hedge the currency pair risk to a certain extent.

Bottom Line: Is NZDJPY a Good Investment Now?

As we have stated in this guide, the NZDJPY pair provides investors with many benefits. While it is not among the most popular currency pairs, as we’ve explained it can still be an interesting addition to your portfolio.

If you wish to invest in NZD/JPY today, you can do so via ZFX. This broker offers many advantages to its clients, as well as solid regulation. You can sign up today by following the tutorial provided in this article.