How to Buy Johnson & Johnson Stock Now, Forecast and Dividend

Are you thinking of buying Johnson & Johnson stock? In this guide, you will learn how to invest in Johnson & Johnson shares and discover price history and forecasts, analyst outlooks and dividend information to help make your investment decision!

This guide will help you learn how to invest in the company’s shares, where to buy Johnson & Johnson stock and discover some insights on its price history, dividend information, analyst outlooks and more.

Johnson & Johnson Overview

Johnson & Johnson is the world’s largest healthcare products maker (based on revenue). It is one of the most well-known and best-loved brands in the industry. The company sells pharmaceuticals, medical devices, baby care products, consumer health products, and more than 200 over-the-counter medicines and products that touch nearly every facet of health care.

The company has been around for over 150 years. It started as a small pharmaceutical business and has since grown into one of the world’s largest healthcare companies. The company was founded in 1886 by three brothers, Johnson and Johnson and Johnson and pioneered the concept of sterile surgical equipment.

Johnson & Johnson Stocks Historical Price

Understanding the Johnson & Johnson stock price history is important when evaluating the company and its potential performance in the future. When Johnson & Johnson went public and listed the company’s shares on the New York Stock Exchange in 1944, JNJ shares were offered at $37.50 each, which adjusted for inflation would be worth $582.88 in 2021.

Considering JNJ shares opened at $172.90 per share in September 2021, that might sound like a bad investment, but when you factor several stock splits and stock dividend bonuses into the equation, the IPO price is adjusted to ¢1.5, which is $2.76 when adjusted for inflation.

J&J stock reached an all-time high of $179.92 on the 20th of August 2021, a 15.15% increase on the opening price on the first trading day of 2021. Johnson & Johnson is often referred to as the abbreviation J&J or the stock ticker JNJ.

The table below shows how J&J stock performed based on historical prices for the past eleven years. Based on the historical J&J stock performance, the share price has grown on average 9.25% annually for the past eleven years.

| Year | Opening price $ | Gain % |

| 2010 | $64.71 | -4.4% |

| 2011 | $62.63 | 5.2% |

| 2012 | $65.59 | 6.9% |

| 2013 | $71.02 | 29% |

| 2014 | $91.14 | 14.7% |

| 2015 | $105.05 | 2.2% |

| 2016 | $101.71 | 13.3% |

| 2017 | $115.79 | 20.7% |

| 2018 | $139.66 | -7.6% |

| 2019 | $128.13 | 13.85% |

| 2020 | $145.87 | 7.9% |

Johnson & Johnson stock split history

Johnson & Johnson has performed seven stock splits and given five stock bonuses in place of dividends. The most recent Johnson & Johnson stock split occurred over two decades ago, on the 22nd of May 2001.

Supposing you owned 100 JNJ shares before the 8th of April 1947, you’d have 249,264 JNJ shares after the most recent split in May 2001.

JNJ stock split history

- 19th of December 1958: JNJ stock was split 5-for-2.

- 17th of April 1970: JNJ stock was split 3-for-1.

- 21st of April 1981: JNJ stock was split 3-for-1.

- 26th of April 1989: JNJ stock was split 2-for-1.

- 19th of April 1992: JNJ stock was split 2-for-1.

- 21st of May 1996: JNJ stock was split 2-for-1.

- 22nd of May 2001: JNJ stock was split 2-for-1.

JNJ stock bonus issue history

- 8th of April 1947: J&J performed a 100% stock dividend bonus by giving shareholders one additional share for each one they already owned instead of cash dividends.

- 25th of October 1948: J&J gave shareholders a 5% stock dividend bonus, meaning the company paid 21-for-20.

- 25th of October 1949: J&J gave shareholders a 5% stock dividend bonus.

- 23rd of February 1951: J&J gave shareholders a 5% stock dividend bonus.

- 22nd of May 1967: J&J performed a 200% stock dividend bonus by giving shareholders two additional shares for each one they already owned instead of cash dividends.

Johnson & Johnson Stockholders

The top ten investment firms and funds with Johnson & Johnson stock positions illustrate large investment firms’ interest in the company.

| Fund | Shares | % Owned |

| Vanguard Group Inc | 227,946,104 | 8.06% |

| State Street Corp | 143,989,480 | 5.1% |

| Blackrock Institutional Trust Company, N.A. | 74,831,068 | 2.7% |

| Blackrock Fund Advisors | 45,546,374 | 1.6% |

| Geode Capital Management LLC | 40,825,241 | 1.4% |

| State Farm Mutual Automobile Insurance Co | 34,574,792 | 1.2% |

| Wellington | 33,886,162 | 1.2% |

| Northern Trust Corp | 32,715,033 | 1.2% |

| Bank Of America Corp /De/ | 28,457,482 | 1.0% |

| Massachusetts Financial Services Co /Ma/ | 27,864,699 | 1.0% |

Why Invest in Johnson & Johnson Shares? Points to Consider

Before investing in any company, you should conduct thorough due diligence. Make sure to consider the following factors:

- The company’s business model and financial health

- The current valuation and price targets for Johnson & Johnson stock

- Any recent news about J&J and relevant industry changes

- Analyst ratings on Johnson & Johnson shares

- The potential profit and risks

Johnson & Johnson stock fundamentals summary

- Johnson & Johnson is listed on the New York Stock Exchange and traded under the ticker symbol JNJ.

- J&J stock is a constituent of the popular S&P 500 and Dow Jones Industrial Average indices.

- J&J revenue in 2020 was $82.57 billion, and net income was $14.71 billion, which is relatively consistent with performance in 2019 and 2018.

- As of the 1st of September 2021, Johnson & Johnson’s market cap was $457.37 billion.

- As of 2020, J&J has 134,500 employees worldwide.

- J&J has executed seven stock splits and issued five stock dividend bonuses. The most recent Johnson & Johnson stock split occurred on the 22nd of May 2001.

- Per the Q2 2021 investor report, J&J’s price-to-sales ratio was 5.06, and the price-to-earnings ratio was 25.41.

- JNJ dividends for 2021 are $4.24 per share, making the dividend yield 2.57%.

- The current average daily trading volume of JNJ shares on the NYSE is 5.3 million shares, equivalent to the notional value of $914.5 million.

Johnson & Johnson business model

Johnson & Johnson is among the top 100 highest-revenue companies in the world and the largest healthcare company. J&J develops, manufactures and distributes pharmaceuticals, medical devices and numerous consumer healthcare brands that you’ll find in most supermarkets and drugstores worldwide.

Besides over the counter healthcare products, the company manufactures medicines and vaccines. J&J acquired Belgian pharmaceutical company Janssen Pharmaceuticals in 1961 and merged with several other pharmaceutical companies to acquire intellectual property, helping the company expand into the vaccine production and treatment of infectious diseases sectors. Janssen Pharmaceuticals focuses on preventing and treating infectious diseases, producing vaccines, addressing neuroscience, oncology, immunology, cardiovascular diseases, and pulmonary hypertension diseases.

In 2020, Johnson & Johnson, through its subsidiary Janssen Pharmaceuticals, began developing a vaccine to protect against infection from the SARS-CoV-2 virus and prevent COVID-19 disease. The vaccine produced by Janssen was popular because of its single-dose characteristic. However, the vaccine had a higher prevalence of side effects among younger recipients than other options like Pfizer, which impacted sales after the most at-risk populations were vaccinated. However, J&J still expects COVID-19 vaccine sales to reach $2.5 billion in 2021.

Johnson & Johnson Stock Dividend Information

One major factor to consider is Johnson & Johnson’s stock dividend policy. The company has increased its payout for 58 consecutive years, and it currently provides a yield of 2.57%. In total, Johnson & Johnson paid almost $10.5 billion in dividends to shareholders. If you are considering investing in stocks with high dividends, this might be one worth investigating.

Johnson & Johnson dividend history

The table below shows the past five years of Johnson & Johnson shares dividend payments to shareholders.

| Declare Date | Amount | Yield | Frequency | Pay Date |

| 24/08/2021 | $1.06 | 2.4% | Quarter | 7/09/2021 |

| 25/05/2021 | $1.06 | 2.5% | 8/06/2021 | |

| 23/02/2021 | $1.01 | 2.5% | 9/03/2021 | |

| 24/11/2020 | $1.01 | 2.8% | 8/12/2020 | |

| 25/08/2020 | $1.01 | 2.7% | 8/09/2020 | |

| 26/05/2020 | $1.01 | 2.8% | 9/06/2020 | |

| 26/11/2019 | $0.95 | 2.8% | 10/12/2019 | |

| 27/08/2019 | $0.95 | 3.0% | 10/09/2019 | |

| 28/05/2019 | $0.95 | 2.7% | 11/06/2019 | |

| 26/02/2019 | $0.90 | 2.6% | 12/03/2019 | |

| 27/11/2018 | $0.90 | 2.5% | 11/12/2018 | |

| 28/08/2018 | $0.90 | 2.7% | 11/09/2018 | |

| 29/05/2018 | $0.90 | 3.0% | 12/06/2018 | |

| 27/02/2018 | $0.84 | 2.5% | 13/03/2018 | |

| 28/11/2017 | $0.84 | 2.4% | 12/12/2017 | |

| 29/08/2017 | $0.84 | 2.6% | 12/09/2017 | |

| 30/05/2017 | $0.84 | 2.6% | 13/06/2017 | |

| 28/02/2017 | $0.80 | 2.6% | 14/03/2017 | |

| 22/11/2016 | $0.80 | 2.8% | 6/12/2016 | |

| 23/08/2016 | $0.80 | 2.7% | 6/09/2016 | |

| 20/05/2016 | $0.80 | 2.8% | 7/06/2016 |

Johnson & Johnson Stock Forecast and Prediction

If you are looking for stocks with low volatility, good value and high growth potential, then Johnson & Johnson stock might be a good investment. Johnson & Johnson stock forecast has a consistent buy rating among analysts and is considered.

- Morgan Stanley analyst Matthew Harrison downgraded JNJ to equal-weight from overweight and set a $187 price target.

- Leerink Partners analyst Danielle Antalffy reiterated a buy rating on JNJ and set a price target of $200.00.

- Argus analyst David Toung maintained a buy rating on JNJ stock and raised the firm’s price target to $190.00 (from $180.00).

- Raymond James analyst Jayson Bedford maintained a buy rating on JNJ and set a price target of $183.

Where to Buy Johnson & Johnson Stocks

You can trade Johnson & Johnson online from almost anywhere in the world. All you need is a stable internet connection, a computer or smartphone and a trading platform such as the powerful MetaTrader 4 platform offered by ZFX. If you want to make sure you know the Johnson & Johnson stock price today and any other day in the future, you should get the ZFX MetaTrader 4 app on your phone.

ZFX – Free platform & market data to trade JNJ stock

Making money by investing in stocks is not easy, but you can make things easier by cutting out unnecessary costs. Most stockbrokers charge subscription fees for market data and trading platform access. ZFX is an innovative online trading broker offering access to global markets from an award-winning trading platform available on any screen. With a ZFX trading account, you get unlimited access to a trading platform with real-time Jonson & Johnson quotes and hundreds of other instruments.

How to Buy Johnson & Johnson Stock Now

Johnson & Johnson shares are traded on the New York Stock Exchange and listed with the ticker symbol JNJ. Johnson & Johnson is a popular stock offered by most brokers and trading platforms.

To start trading Johnson & Johnson today, just follow these simple steps:

- Register with ZFX

- Verify your ZFX account

- Make your first deposit

- Buy Johnson & Johnson stock

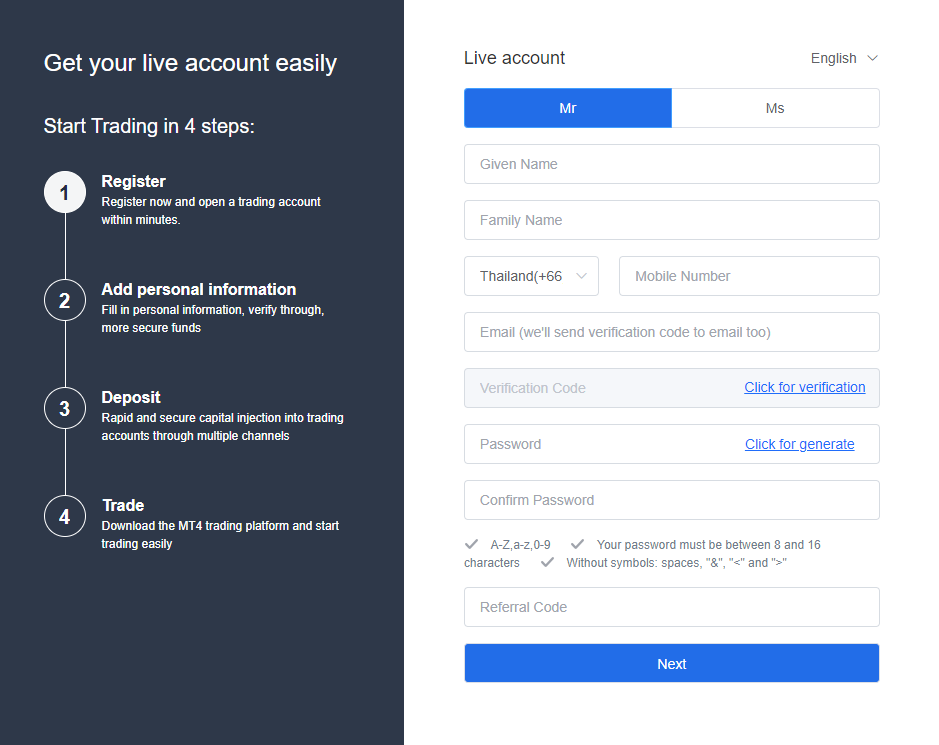

1 – Register with ZFX

The registration process starts when you go to ZFX’s main website and select the blue “Open an account” button located at the upper right side of the screen. Hitting the button will take you to a new window shown next.

Simply fill in the registration form and click ‘Next’.

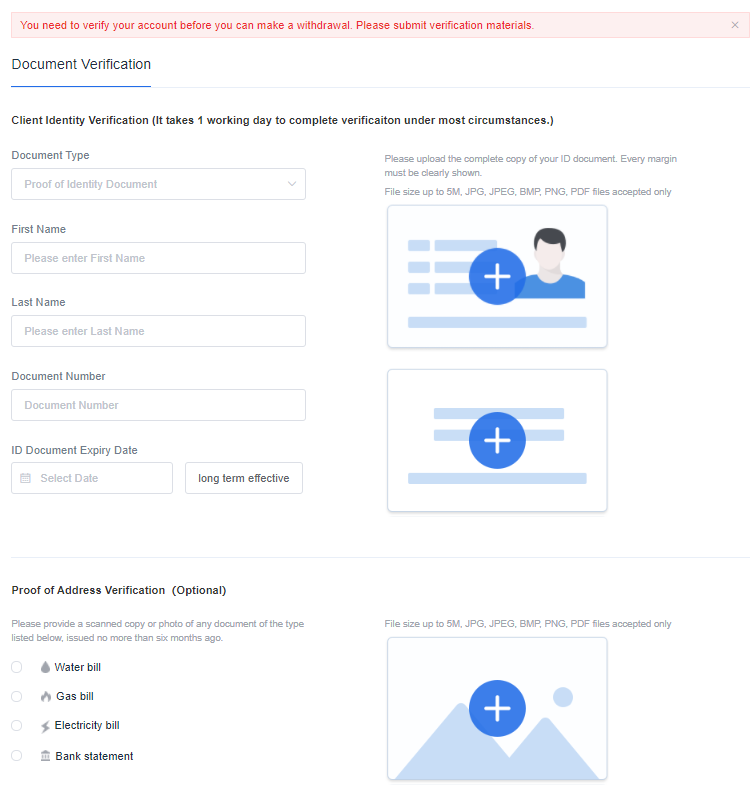

2 – Account verification

ZFX will then want to verify your identity and bank account. To do so, prepare these verification documents: passport, national ID, or Driver’s license. You will simply have to scan your document. You can verify your bank account through a bank statement or a copy of the bank book.

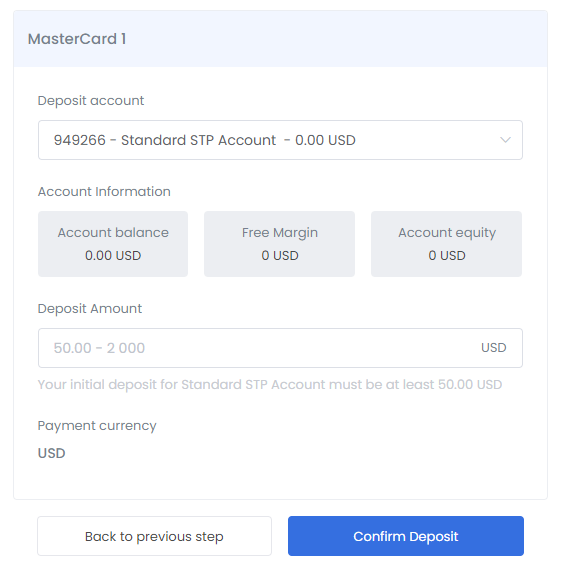

3 – Make your first deposit

Depositing funds to your account is simple. When logged in, click the “Deposit” option from the menu. ZFX offers multiple funding methods. Hence, you can place funds on their accounts with Bank Wire or Credit Cards. It should be noted that, while it is common for some brokers to charge deposit or withdrawal fees, ZFX doesn’t charge any deposit or withdrawal fees.

4 – Buy Johnson & Johnson stock

Once you have made a successful deposit, you can buy JNJ stock through the popular MT4 platform. To do that, you need to download the suitable ZFX MT4 trading platform for your device.

Once you download the MT4 platform, you need to log in with the details sent to your email address. You open the MT4 platform, then select the “Accounts” option on the left side and enter your user ID and password in the window that will emerge.

Next, you double click on Johnson and Johnson stock, which will open a graph with Johnson & Johnson stock quote in real-time. To buy or sell the financial asset, you need to set the desired volume, order type, and if you want, ZFX MT4 gives the option for defining a stop loss or take profit levels.

Bottom Line: Should You Buy Johnson & Johnson Stock?

If you’re still asking yourself, is Johnson & Johnson a good stock to buy, you might need to do more research or follow the company’s performance for a longer horizon.

The bottom line is the company is a well-established and diversified healthcare conglomerate with a history of innovation and strategic acquisitions. It’s also one of the world’s most recognised brands, which means it has staying power in an industry that can change quickly.

The company has been in the spotlight recently due to the COVID-19 pandemic due to its vaccine development, which could be a blessing or curse; it’s too early to tell.