How to Set a Take Profit in Forex?

Every investor should have experienced the situation where the profit made declines dramatically or even becomes loss due to the reversal of market trends. What if you can always exit a trade at the market high? This is when a take profit order should come into play. A good take profit strategy can greatly reduce the probability of such a situation. This article will introduce you how to set a take profit order on the MT4 platform, as well as the principles and skills of setting a take profit order.

1. What does Take Profit Means?

‘Take profit’ and ‘stop-loss’ are two very similar concepts. If stop loss is to control the scope of loss, then take profit is to ensure that the trader will make a profit on the trade. In the forex market, a take profit order refers to a standing order in a place where the trader has set a price limit (take profit point) at which the open position he or she has held will be automatically closed out, so as to maximize the profits for traders.

2. Should I Set Take Profit in Forex Trading?

As we mentioned, in fact, taking profit is a means to help traders maximize profit. Some people might say, wouldn’t it be easier to make more money if you don’t set a price limit? That is correct in theory, but it may not work in practice.

Forex trading itself is all about predicting market trends, but the market movements are so volatile that any analysis is only a possibility. On such a premise, the market itself is a game of human nature. Especially when traders notice that the market is moving in a favorable way and their positions have increased in value, their feelings of greed and fear will be magnified. If you have been holding a profitable position and refuse to close it, it is likely for you to incur losses in the event of a sudden reversal of the trend, and all the time you have sent will be wasted.

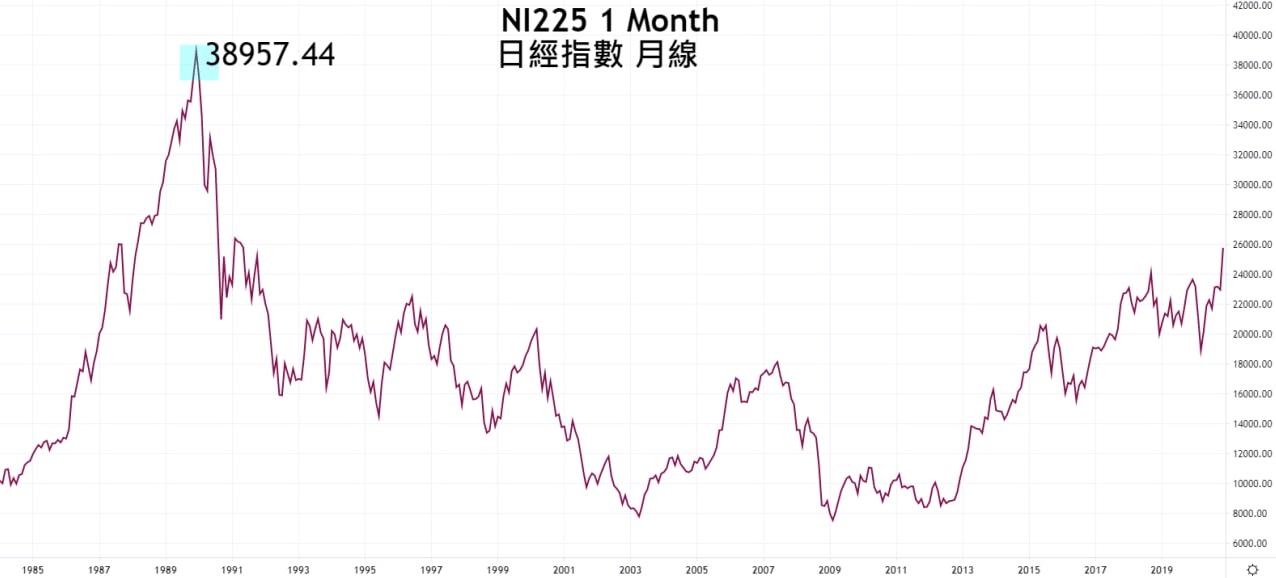

Take the performance of the Nikkei Index as an example, after it reached the highest point of 38,957.44 in 1989, there was a rapid decline, which showed that trend reversal could occur even in the great bull market. If investors did not foresee the crisis and take profits in time, they might be trapped for 30 years.

Of course, such a case is rare. What investors should pay attention to is, Although you may will miss some big opportunities if you take the profit, timely execution of taking profit can not only guarantee profits but also have the effect of risk avoidance. Therefore, investors should not reject the behavior of setting take-profit, but should design reasonable stop-interest rules, and implement them in the trading, so as to achieve the purpose of steady profit in the long run.

Veterans of the financial markets always say that “you never know when the market will change”. Some strategic analysts will also suggest that “close half of your position when you make a reasonable profit”.

3. How to Set a Take Profit Order on MT4

Before we teach take profit technique, let’s take a look at how to set take-profit on the MT4 platform.

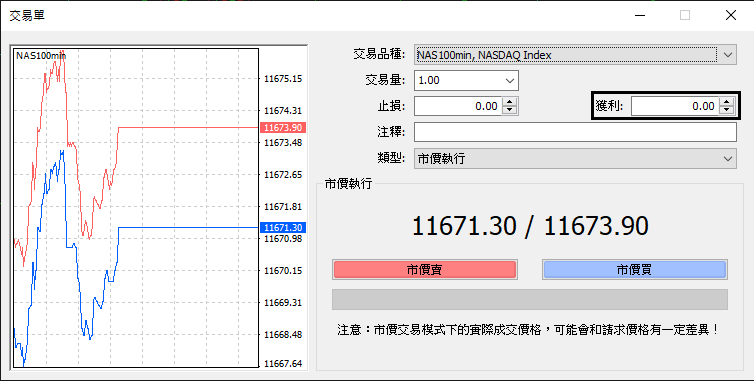

Scenario 1: Set take profit when you open a position

When you click on the new order to establish a position, you will see the confirmation information at the bottom. Before opening a position, in addition to setting the position size, you can also enter a custom value in the “profit” column (black box) at the bottom. When the market goes up / down to the price you set, it will automatically trigger the operation of closing the position.

Screenshot 1: How to set take profit when building a position

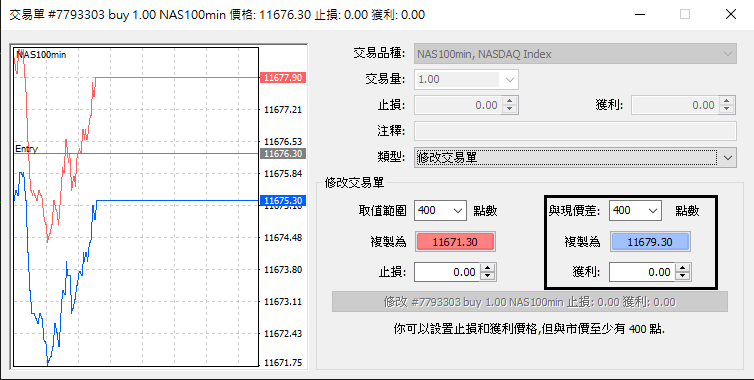

Scenario 2: Set take-profit on an established position

To set stop interest on an established position, you can open the terminal page at the bottom first, then right-click on the order to adjust, and select the option “Modify or Delete Order”. You will see the picture below, and then you can set take profit for the order.

Screenshot 2: How to set take profit on an established position

Scenario 3: Use trailing-stop to set take profit

In MT4, you can use the trailing stop function to set take profit. The reader may wonder, what is the connection between the trailing stop and take profit? So let’s explain the use and meaning of trailing stops.

4. How does trailing stop work?

Trailing stop refers to the stop that has been adjusted according to the market trend. The logic is that when the market is moving in your favor, you can move your price limit closer to the market price, or even skip the stop. On the contrary, the price limit would not change if the market movement is unfavorable, so when the market reverses, you can lock in the profit of the position.

Suppose you buy EUR/USD at 1.1880 and place a 30-point stop loss at 1.1850. When the trend moves 50 points in the favor to reach 1.1930, you can choose to move the stop 50 points up to 1.1900. Even if the market hits the stop-loss price in a later reverse, the profit is guaranteed.

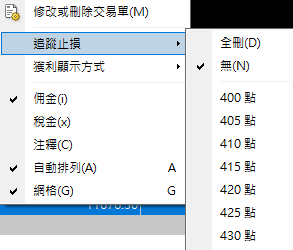

How do I enable trailing stops on MT4?

This can be set manually or automatically. You can open the terminal page at the bottom of MT4, right-click the order to be adjusted, and select the “trailing stop” option. You will see the picture below. At this time, you can set a trailing stop for the order.

Note that 1 pip in MT4 refers to the last decimal place of the quotation. According to current quotation rules, 400 pip in the figure above represents “40 pips” of the currency pair.. MT4 also provides a custom range that gives the trader the freedom to set the maximum distance between the current price and the stop price once the trailing stop is set. In addition, if the position has a trailing stop, a “T” will appear next to the order number.

However, the logic of MT4’s trailing stop is different from the ones in the market, so it is more suitable for experienced investors. It is recommended for investors to practice it and understand it clearly using the simulated account first to avoid unnecessary operation errors.

Pros and cons of trailing stops

Of course, if the trend is extremely strong and the price continues to move in a favorable direction, then the trailing stop function will allow investors to feel at ease to hold the position and do not have to worry about the reversal of the market. The effect of reducing risk and maximizing returns has been turning trailing stop into taking profit effectively.

However, the financial market is volatile, and there is not always a trend in the market. Sometimes, the market will fluctuate repeatedly. In this case, the disadvantage of trailing loss is obvious. Volatility will increase the probability of touching the price limit, causing investors to execute the stop loss by mistake and miss the upward and downward trend after consolidation.

5. Take Profit Tips and Strategies

1 / In terms of price change

Based on the entry price, when the profit reaches a certain level, take the profit. For example, 50 pips above the entry price. If you are bullish on GBP / USD and the purchase price is 1.3280, the stop point is set at 1.3330. It can also be calculated as a percentage. For example, If you plan to take the profit after GBP /USD has increased by 0.5%, it will be equivalent to 67 pips, then the price limit will be set at 1.3347.

2 / Based on the ratio of stop profit and stop loss

The distance between stop loss and stop profit should be in a reasonable proportion. If 50 pips profit is the target for each transaction, the distance between stop loss price and the market price will not be more than 50 pips. It can be set as 1:1 (take profit and stop loss at 50 pips) or 2:1 (take profit at 50 pips and stop loss at 25 pips), or you can adjust the ratio between the two.

3 / In proportion to the capital

You can set a take-profit point based on a certain percentage of your own funds when you trade, such as 5%-10%. For example, if you have $10000 in the account and you aim to make a profit of 5%, then your profit target can be set at about $500. This method can also be used to measure the monthly or longer return rate. Setting a profit target for yourself can also help avoid excessive trading.

4 / In combination with technical analysis

Traders who like technical analysis will also use technical graphics and indicators to help set take profit point. For example, you can buy at the lower edge and close at the upper edge of the uptrend channel; in addition, you can calculate the potential rise and fall by using the head shoulder pattern. In terms of technical indicators, statistical indicators, such as ATR, are used to measure the recent volatility of some trading targets, so as to avoid improper stopping distance.

Learn how to use ATR Indicator: ATR Indicator Guide: How to Use ATR in Forex Trading

If you can use these techniques skillfully, your take profit strategy can be more specific, and sometimes it can help you filter out some misjudgments.

—

About ZFX (Zeal Capital Market)

- The Best Trading Platform Award 2019 from Financial Weekly, Regulated by FCA & FSA.

- 100+ trading assets, including Forex, Stocks, Indices, Gold, Crude Oil, etc.

- 3 types of trading accounts to meet the needs of every customer

- 0 commission, low spread, leverage ratio up to 1:2000

- Powerful trading platform that executes 50,000 orders/s

- Open an account with a minimum deposit of $50

- 24-hour Customer Service

——

Risk Warning: The above content is for reference only and does not represent ZFX’s position. ZFX does not assume any form of loss caused by any trading operations conducted in accordance with this article. Please be firm in your thinking and do the corresponding risk control.