WTI Oil Futures: Price Chart, Overview and How to Invest

WTI oil futures are among the most popular ways to invest in oil, both short and long term. This analysis will explain in detail what oil futures are and how they work. We’ll also discuss WTI oil futures forecasts, so you’ll know whether to expect a rise or fall in price. Finally, we will introduce you to a broker we believe is one of the best to start investing in WTI oil futures.

What Are WTI Oil Futures? Overview

WTI oil, or West Texas intermediate, refers to crude oil extracted in the United States. It is, along with Brent, one of the two global oil price benchmarks. USOIL futures are used for trading the future price of oil. For example, it allows you to buy oil at today’s price delivered in 2 months. From an investor’s perspective, futures are one of the most popular financial instruments for investing in commodities.

WTI oil futures are an alternative to WTI Oil CFDs for trading oil prices. However, it should be noted that the capital required to access WTI oil futures is generally much higher than that of WTI oil CFDs. Note that the official WTI oil futures symbol is “CL”

WTI Oil Futures Price History and Price Today

This section will look at the WTI oil futures historical price, including identifying the major phases of its development and the crises that have marked its history.

WTI Futures Price Historical

Oil became crucial to economies in the 19th century, following the development of industries such as the automobile one. In the beginning, the evolution of oil prices depended on the number of cars in circulation globally, and its evolution was relatively predictable and regular.

In 1973, the oil market experienced its first shock following the Egyptian and Syrian attacks on the State of Israel. On this occasion, OPEC manipulated prices, which caused the price of WTI oil futures to rise by 70%. In 1979, another conflict in the Middle East, the war between Iran and Iraq, also led to a sharp rise in prices caused by a drop in production of both nations involved.

In the second half of the 1980s, the world economy then went into recession. This led to a fall in consumption and, therefore, oil demand, and the WTI oil futures fell. Then, in the early 1990s, the Gulf War between the United States and Iraq caused oil prices to rise sharply. More recently, the conflict in Libya in 2011 caused a sharp rise in prices, leading to a peak of $135, an absolute record that has not been matched since.

Finally, the last crisis in the oil market occurred in 2020 in the face of the coronavirus pandemic, which brought the world economy, and therefore oil consumption, to a standstill. However, after crossing into negative territory in March 2020, oil has shown a robust recovery, so much so that it is currently back above $80 a barrel.

What Influences the Price of WTI futures?

Let’s look at the main factors that influence the WTI crude oil futures price up or down.

- The world oil supply is controlled mainly by a handful of producing countries members of OPEC. OPEC applies strict controls on the oil production of its members, in particular though quotas. These quotas are very influential on supply. Therefore, OPEC decisions can have a considerable and immediate impact on the WTI crude oil futures price.

- Demand for oil comes mainly from the consumption of gasoline and the production of electricity. And while the world moves towards cleaner energy (and should, therefore, move away from oil), technological challenges still remain before the transition to clean energy is viable and compete. So, oil demand still has a long way to go, which should benefit the WTI oil futures price.

- Statistics on the weekly economic calendar, such as US Oil Inventories, also influence prices. Indeed, higher than expected inventories will be a bearish factor for crude oil futures, and inventories falling more than expected may be a bullish factor. Thus, WTI oil futures traders should follow this weekly publication, especially short term traders.

- Since many oil-producing countries are geopolitically unstable areas, geopolitics have a significant impact on futures price, as we have seen from the various crises in oil history. Therefore, it is essential to follow the news and learn about the geopolitical climate in the Middle East to anticipate the evolution of WTI crude oil futures correctly.

WTI Oil Futures Chart

This section will be dedicated to studying the long-term WTI crude oil futures chart. Indeed, whether you plan to invest in WTI oil futures in the short term or long term, it is essential to take a step back to see what the underlying trend is. We will base our observations on the monthly chart below:

This chart shows that after being stuck below a downtrend line since the July 2008 high, WTI crude oil futures has managed to break through this barrier in 2021. The breaking of such a long-term downtrend line is a powerful bullish signal. In addition to this, traders should consider that WTI oil futures broke through their 50, 100, and 200-week moving averages, which is also a very bullish signal.

To summarize, WTI oil futures prices are in a bullish reversal of the long-term trend. Since this reversal is confirmed from a chart perspective, now may be a good time to buy crude oil futures.

Why Invest in WTI Oil Futures Today? Points to Consider

Below, we will outline the main arguments and strengths that may lead investors and traders interested in this commodity.

- WTI oil futures, and oil in general, are particularly volatile. Volatility is a source of risk, but also of trading opportunities. This is why short-term traders are particularly fond of this asset.

- As with all commodities, oil futures can be traded with high leverage. This further increases the already high-profit potential due to the natural volatility of this asset.

- Traders can trade US oil price futures 24 hours a day, 5 days a week. This makes it a popular instrument for novice traders who can trade oil futures in the evenings after work, until they are ready to make a career of it.

- Finally, the oil outlook remains favorable, both from a technical and economic perspective. In other words, the odds are clearly in favor of higher US oil futures price.

Where Can I Trade WTI Oil Futures?

The easiest way to trade oil futures is to go through a regulated and efficient broker, such as ZFX. ZFX provides its clients with the MT4 trading platform, which is the most widely used globally thanks to its many technical analysis and automated trading advantages. It is with this platform that you will be able to follow WTI oil futures live. Finally, it is worth noting that ZFX offers its clients to trade stocks, indices, forex and commodities.

How to Trade the WTI Oil Futures Easily

Buying WTI oil futures through the broker ZFX is simple and fast. Indeed, the account opening is done entirely online, and takes only a few minutes. All you have to do is follow these steps.

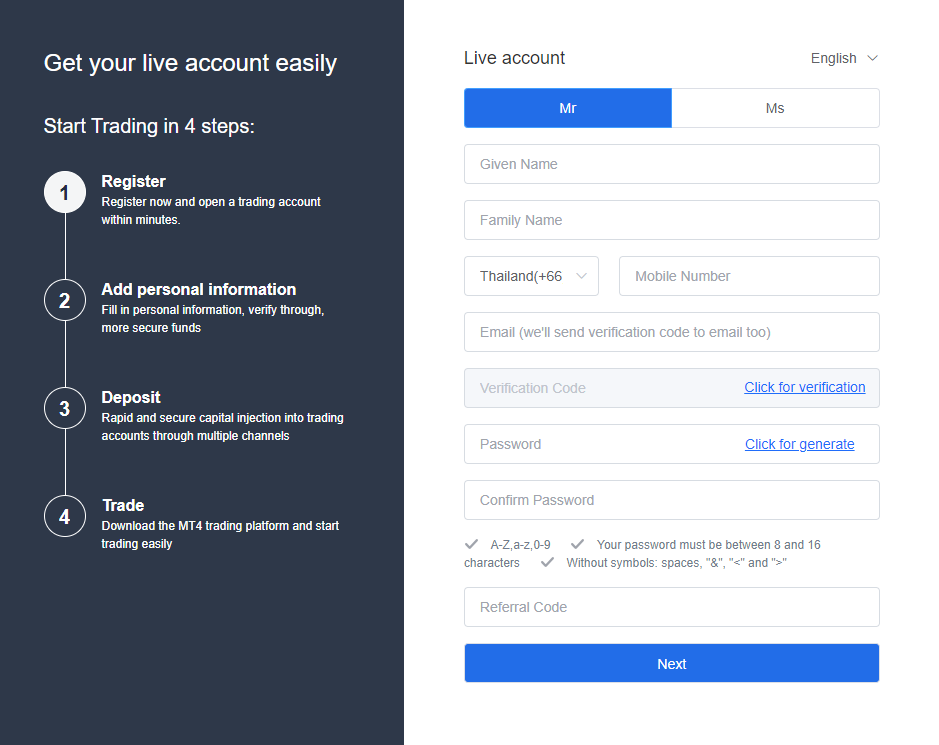

1 – Register with ZFX

For this first step, you will need to go to the ZFX broker’s website, and click on the “open an account” button. You will then have to fill in a registration form with several personal details, including your phone number, which will be verified by SMS.

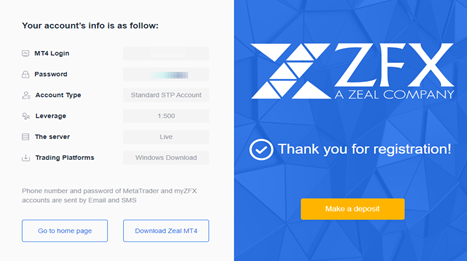

After filling out the form, click on the “Next” at the bottom of the page. Immediately after this step, ZFX will display your MT4 login and password, and invite you to download the platform.

2 – Make your First Deposit

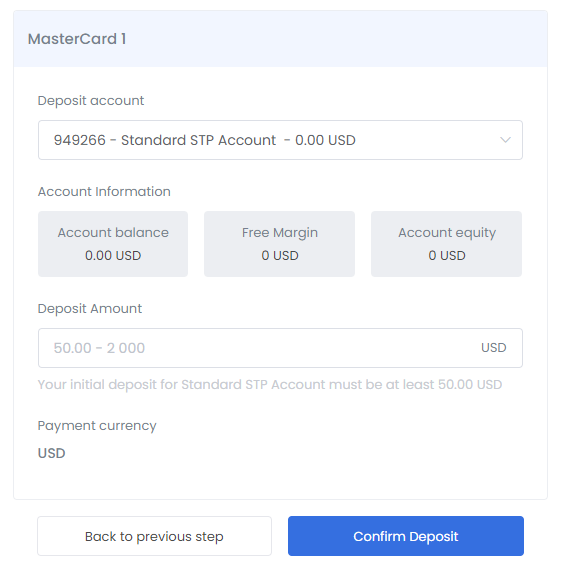

To do this, you will need to click on the “Make a deposit” button on the screen that is displayed immediately after registration. You will then be asked to choose a payment method. Let’s take Mastercard as an example:

On this screen, indicate the deposit amount and then click on “Confirm Deposit”. You will then be asked for your credit card information before the final validation of the payment.

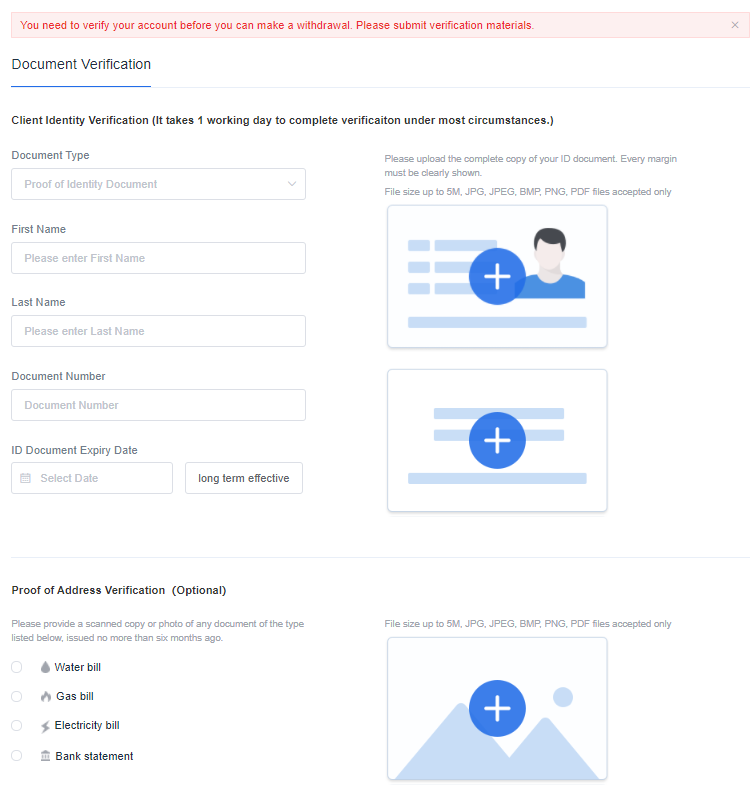

3 – Account Verification

Finally, you’ll need to proceed with the account verification by sending supporting documents.

As shown in the image above, simply upload the documents directly to the ZFX website.

4 – Trade USOIL Futures

Once your documents are validated, you will then be ready to buy WTI futures. Download the MT4 and access the platform using your provided logins.

Things to Know Before Trading WTI oil futures

Following the few rules and tips we list below will probably get you started trading oil futures with a good chance of success.

- Technical analysis is a must for all traders. It allows you to predict WTI crude oil futures price and determine potential targets, based solely on charts. Even though it’s a top tool for day traders, it is also essential for long term traders, for reading underlying trends.

- As explained earlier, oil is probably the asset most influenced by geopolitics. As a result, make sure to follow the news in the Middle East, because conflicts in the area directly impact the price of black gold.

- Demo trading replicates the conditions of actual trading, but with virtual money. This allows you to practice, test and refine your methods without risking losing money. Most traders start their career by learning on a demo account before start trading for real.

- It is essential to choose a good broker that offers a good trading platform and has reasonable fees. It is also essential to choose a regulated broker, as this is a guarantee of security. Note that the broker we recommend, ZFX, meets all these criteria.

WTI Oil Futures Forecast, Future, and Prediction

Let’s now study of forecasts for USOIL price futures. We will discuss the macroeconomic context and its potential for oil and look at the chart and technical context.

WTI oil futures forecasts: Macroeconomic analysis

Two major factors dominate the long-term future of oil prices: supply and demand.

- On the supply side, it is essential to remember that oil reserves are not infinite. Experts even believe that the oil peak has already been exceeded and that production will fall globally from now on. In other words, oil will become more scarce, and supply will decrease. This will have a bullish impact on the WTI crude oil futures price.

- The other side of the equation, demand, will be affected by the global transition from fossil fuels to clean energy. This transition should have a downward impact on oil demand, and a mechanical downward effect on the price of black gold.

So, we have 2 factors that are in opposition. Therefore, the question is: can the world make a complete transition to clean energy before oil reserves decline significantly? In this regard, we should note that the complete transition to clean energy will still require many technological challenges. And there is no guarantee that these challenges will be successfully met quickly.

Thus, there is a good chance that oil demand will remain for several more decades, a period during which oil should become increasingly scarce. All in all, there are good reasons to expect WTI oil futures to rise in the long term.

USOIL Futures Forecast: Technical Analysis

Let’s move on to the study of the chart and technical context of WTI oil futures. We will base our observations on the weekly WTI crude oil futures chart.

It is easy to see on this chart that WTI oil price futures are following an obvious uptrend following the collapse it suffered in the face of the onset of the covid-19 pandemic in March 2020.

This uptrend received further confirmation and momentum when WTI crude oil futures price broke through long-term resistance at $75. It is now trading above $80, and there are good technical reasons to think that the $100 mark is within reach.

Bottom Line: Should I Invest in WTI Oil Futures Now?

Although short-term traders generally like WTI oil futures due to their volatility, it is an investment that may be suitable for long-term investors as well. And with the transition to clean energy likely to take longer than expected, we can expect oil demand to remain strong over the next few years, as oil becomes increasingly scarce and more expensive to extract. This is indeed a fundamentally bullish context for WTI oil futures, and is confirmed by chart analysis.

If you would like to boost your portfolio with a position in WTI oil futures or if you would like to trade oil on a daily basis, you can open a ZFX account now. For all the reasons outlined in this guide, it is one of the best intermediaries for investors interested in trading WTI oil futures.