What is CFD? Learn how CFD Trading works with Examples

CFD (Contract for Difference) has become one of the most popular financial derivatives with high daily trade volumes. Before entering the world of trading with your hard-earned money, it is important to have a thorough understanding of the financial product you’ve chosen.

ZFX hereby offers an in-depth explanation of CFD in terms of product features, principles, trading cost, and the range of tradable assets to help new investors avoid making losses in vain because of misunderstanding.

What is CFD?

CFD is an emerging financial derivative among investors. It is a financial contract of any tradable assets including forex, stocks, indices, commodities, and cryptocurrencies with no physical delivery. CFDs trading is cash-settled, which means traders pay only the differences in the settlement price between the open and closing trades.

How CFD Trading Works

CFDs trading is like the general operation of financing/margin trading, which is supported by the credits from the bank/broker. You pay a certain amount of margin– generally 1-5% of the contract’s gross value- as agreed to open an account (the initial position) and obtain the full amount of the tradable assets. You can start speculating profits with an agreed price difference between the positions you buy and sell. Notwithstanding, additional capital is incurred for maintaining the contract sometimes, even under normal circumstances. In case, when price moves cause a greater potential loss than the margin required, it will trigger a forced liquidation at once.

Let’s say ZFX offers leverage of 1:100 on gold trading. It allows investors to trade gold equivalent to $10,000 on the market with a margin of $100. You will make a $100 profit with the long-positioning contract when the price rises by 1%. On the contrary, you will suffer from a total loss if the price falls by 1%.

CFD Feature 1: Both Long & Short Positions Applicable

You can open a contract by paying a certain amount of margin and start speculating on the price moves for profit-making, regardless of the target asset’s price goes up or down. CFD trading allows investors to trade any direction of securities over the very short-term, which makes itself different from traditional trading.

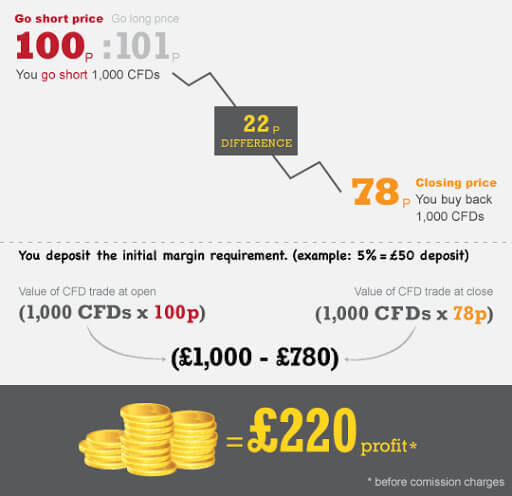

Take Apple (NASDAQ: AAPL) as an example. When you believe that its price will decline, you can open a short-selling position and close the position at a lower price. Accordingly, you can make profits from the difference in the value of stocks the time the contract opens and closes, vice versa.

CFD Feature 2: Leverage Trading with Low Trading Cost

Leverage is another feature of CFDs trading that allows investors to obtain a full contract/position without having to put in all costs. Leverage can magnify the potential revenue; however, the corresponding potential loss in trade is also simultaneously enlarged. You should pay attention to such potential risks and carry out well-arranged risk management.

You can process CFDs trading on any tradable assets equivalents to $10,000 by paying just $100 margin when the leverage comes to 100:1.

Learn More: How to Trading on Leverage? Calculate Leverage & Margin

CFD Feature 3: No Physical Delivery

CFDs trading is a non-deliverable financial derivative. Unlike futures, CFD has no delivery of physical goods or securities with it and it’s cash-settled through the account during closing. Theoretically, CFDs trading is termless but has indefinite useful lives, until a close order is made. Notwithstanding, there are expiration dates designated to certain contracts. In such cases, you must exit the position before the due date; otherwise forced liquidation would be performed.

CFDs traders usually make profits from the price difference between the position they enter and exit. In the ordinary course of the event, profit is made when the bid price plus its cost is lower than the asking price, vice versa.

Bid Price + Cost – Ask Price = Profit/Loss

These are the basic principles of CFDs trading, where the cost of opening a contract directly affects the profitability of the investment. Below will introduce several types of trading cost:

Credit: ws-alerts.com

——

Trading Costs of CFDs

CFDs involve 3 types of trading costs: Spread, Overnight Interest and Commission.

Spread

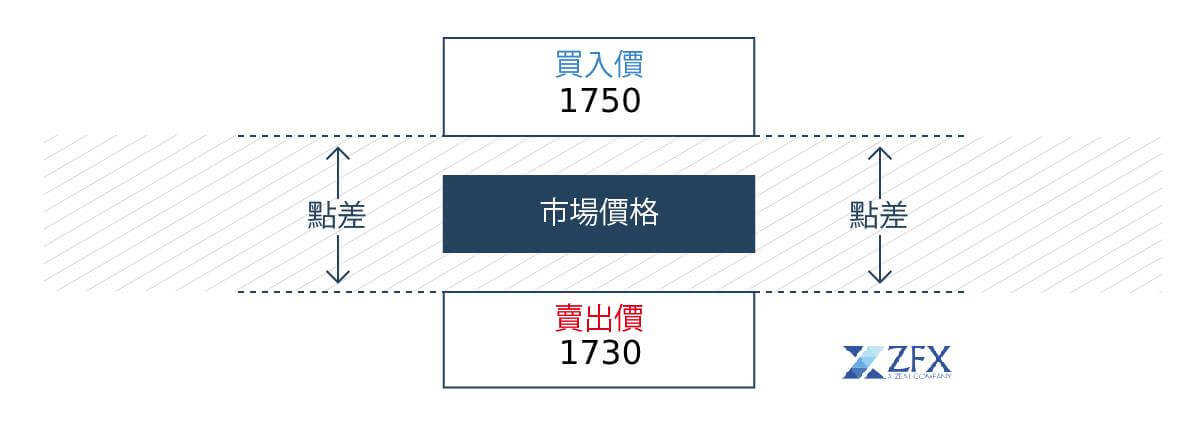

Spread is the difference between the bids (buy) and ask (sell) price at that point in time. For instance, you open a long position on Gold at a buy price of $1750 and the selling price at that point in time is $1730, the spread you pay is $20. (Cost of spread is incurred within the prices of buy and sell but not applicable for the calculation above, otherwise double counting)

Swap (Overnight Interest)

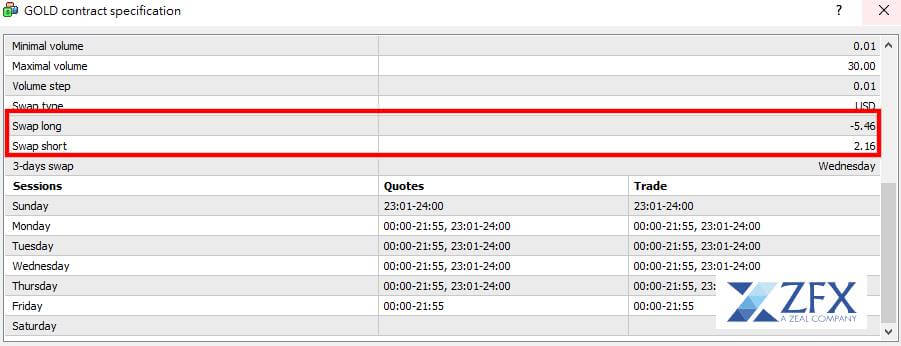

All positions opened in your account are subject to a charge of holding cost- swap maculation- at the end of each trading day, relies on your positions’ direction and the applicable holding rate. (Subject to adjustments from time to time)

The above example of how ZFX charges for overnight interest, as shown in the figure above, a long trade on Gold holding in hand to the next trading day charges investors $5.46, and $2.16 for short trading.

Learn More: What is Swap in Forex? | Fee Calculation for Overnight Positions

Commission

You are also asked for paying a separate commission in different amounts according to the trade conditions of various platforms.

——

Regulation Mechanism of CFD Brokers

Although CFD is one of the new derivatives with complex structures, CFD brokers are under strict regulation of several authorities to ensure legitimacy and stability. To ensure your trading and capital security, you should pay attention to the broker you’ve chosen.

Following are the four of the most authoritative institutions that strictly evaluate and supervise traders:

1. U.K. Financial Conduct Authority (FCA)

2. Australian Securities and Investments Commission (ASIC)

3. U.S. Commodity Futures Trading Commission (CFTC) (Only available to the U.S. domestic traders)

4. EU Financial Instruments Market Management (MiFID)

——

Ranges of Tradable Assets on CFDs

There are more than 2500+ types of tradable assets on CFDs – including Forex, stocks, indices, commodities, and cryptocurrencies– for investors’ selection, and below are the most common categories.

- Forex: EURUSD, GBPUSD, GBPJPY, AUDCHF, USDCAD, and CHFJPY, etc.

- Precious Metal CFDs: Gold, Silver, Palladium or Platinum

- Stock Index CFDs: Major Indices around the world

- Share CFDs: Blue Chips Stocks listed on the US Stock Market

- Agricultural Commodity Futures CFDs: Wheat, Soybeans, Oats or Corn

- Metal Commodity Futures CFDs: Copper, Aluminium

- Energy Commodity Futures CFDs: Crude Oil, Natural Gas

- Cash Crop Commodity Futures CFDs: Coffee, Cocoa and Sugar

- Bond Futures CFDs

Certain types of the assets above require special attention due to its characteristics, below explained.

Forex trading is the most popular form of CFD trading and determined by the exchange rates of various currencies. For example, the value of EURUSD is on the exchange basis of 1Euro to USD. The unit of profit/loss of each currency is presented in USD internationally. Likewise, the loss in GBPJPY is calculated in USD instead of JPY.

Besides, investors who trade CFDs on stocks conferring no right to vote or obtain dividends, generally entitled to ordinary shareholders, at the annual general meeting of a company. Since CFDs trading has no direct impact on stocks’ prices, traders who have no empowerment on relevant assets can only take up the results relying on the company policy passively. On the other hand, trading platforms would adjust prices on CFDs in due course on the dividend declaration date, reflecting the effect of interest on the CFDs’ prices.

——

Risk Warning: The above content is for reference only and does not represent ZFX’s position. ZFX does not assume any form of loss caused by any trading operations conducted in accordance with this article. Please be firm in your thinking and do the corresponding risk control.

ZFX (Zeal Capital Market) is an online forex & CFD broker providing more than 100 products for Forex trading, commodity trading, index trading, and share CFDs trading. The minimum deposit for the account opening is only USD 50. Open a trading account and download our MT4 trading platform now!